Vector Autoregressions tsa.vector_ar¶

VAR(p) processes¶

We are interested in modeling a \(T \times K\) multivariate time series \(Y\), where \(T\) denotes the number of observations and \(K\) the number of variables. One way of estimating relationships between the time series and their lagged values is the vector autoregression process:

where \(A_i\) is a \(K \times K\) coefficient matrix.

We follow in large part the methods and notation of Lutkepohl (2005), which we will not develop here.

Model fitting¶

Note

The classes referenced below are accessible via the

statsmodels.tsa.api module.

To estimate a VAR model, one must first create the model using an ndarray of homogeneous or structured dtype. When using a structured or record array, the class will use the passed variable names. Otherwise they can be passed explicitly:

# some example data

In [1]: import numpy as np

In [2]: import pandas

In [3]: import statsmodels.api as sm

In [4]: from statsmodels.tsa.api import VAR, DynamicVAR

In [5]: mdata = sm.datasets.macrodata.load_pandas().data

# prepare the dates index

In [6]: dates = mdata[['year', 'quarter']].astype(int).astype(str)

In [7]: quarterly = dates["year"] + "Q" + dates["quarter"]

In [8]: from statsmodels.tsa.base.datetools import dates_from_str

In [9]: quarterly = dates_from_str(quarterly)

In [10]: mdata = mdata[['realgdp','realcons','realinv']]

In [11]: mdata.index = pandas.DatetimeIndex(quarterly)

In [12]: data = np.log(mdata).diff().dropna()

# make a VAR model

In [13]: model = VAR(data)

Note

The VAR class assumes that the passed time series are

stationary. Non-stationary or trending data can often be transformed to be

stationary by first-differencing or some other method. For direct analysis of

non-stationary time series, a standard stable VAR(p) model is not

appropriate.

To actually do the estimation, call the fit method with the desired lag order. Or you can have the model select a lag order based on a standard information criterion (see below):

In [14]: results = model.fit(2)

In [15]: results.summary()

Out[15]:

Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Mon, 14, May, 2018

Time: 21:48:15

--------------------------------------------------------------------

No. of Equations: 3.00000 BIC: -27.5830

Nobs: 200.000 HQIC: -27.7892

Log likelihood: 1962.57 FPE: 7.42129e-13

AIC: -27.9293 Det(Omega_mle): 6.69358e-13

--------------------------------------------------------------------

Results for equation realgdp

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.001527 0.001119 1.365 0.172

L1.realgdp -0.279435 0.169663 -1.647 0.100

L1.realcons 0.675016 0.131285 5.142 0.000

L1.realinv 0.033219 0.026194 1.268 0.205

L2.realgdp 0.008221 0.173522 0.047 0.962

L2.realcons 0.290458 0.145904 1.991 0.047

L2.realinv -0.007321 0.025786 -0.284 0.776

==============================================================================

Results for equation realcons

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const 0.005460 0.000969 5.634 0.000

L1.realgdp -0.100468 0.146924 -0.684 0.494

L1.realcons 0.268640 0.113690 2.363 0.018

L1.realinv 0.025739 0.022683 1.135 0.257

L2.realgdp -0.123174 0.150267 -0.820 0.412

L2.realcons 0.232499 0.126350 1.840 0.066

L2.realinv 0.023504 0.022330 1.053 0.293

==============================================================================

Results for equation realinv

==============================================================================

coefficient std. error t-stat prob

------------------------------------------------------------------------------

const -0.023903 0.005863 -4.077 0.000

L1.realgdp -1.970974 0.888892 -2.217 0.027

L1.realcons 4.414162 0.687825 6.418 0.000

L1.realinv 0.225479 0.137234 1.643 0.100

L2.realgdp 0.380786 0.909114 0.419 0.675

L2.realcons 0.800281 0.764416 1.047 0.295

L2.realinv -0.124079 0.135098 -0.918 0.358

==============================================================================

Correlation matrix of residuals

realgdp realcons realinv

realgdp 1.000000 0.603316 0.750722

realcons 0.603316 1.000000 0.131951

realinv 0.750722 0.131951 1.000000

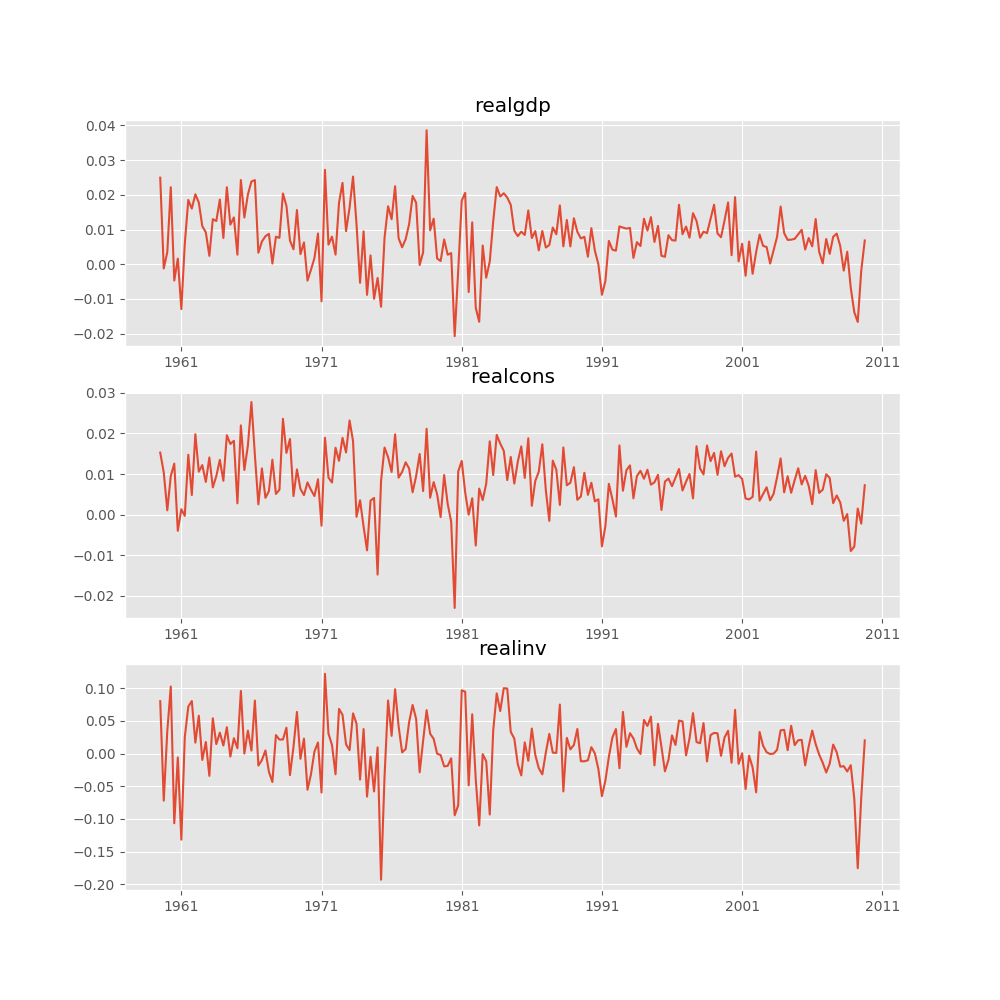

Several ways to visualize the data using matplotlib are available.

Plotting input time series:

In [16]: results.plot()

Out[16]: <Figure size 1000x1000 with 3 Axes>

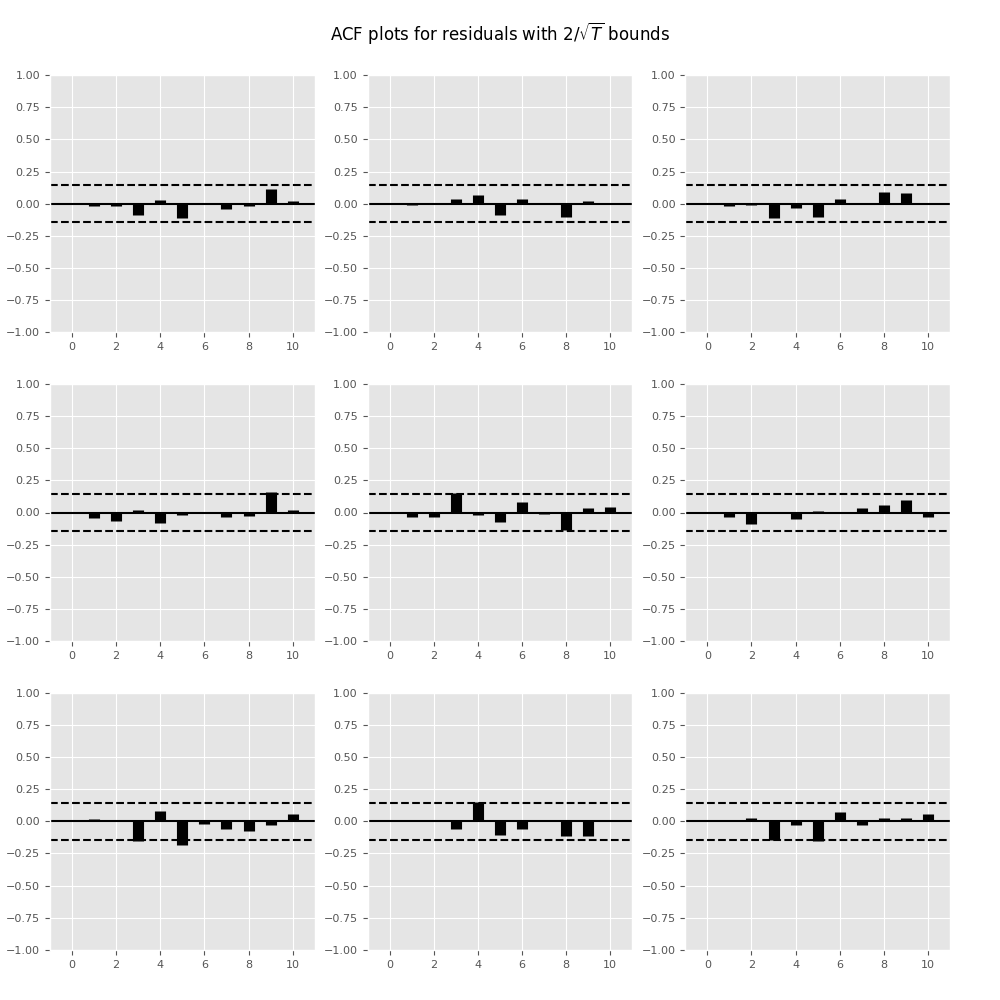

Plotting time series autocorrelation function:

In [17]: results.plot_acorr()

Out[17]: <Figure size 1000x1000 with 9 Axes>

Lag order selection¶

Choice of lag order can be a difficult problem. Standard analysis employs

likelihood test or information criteria-based order selection. We have

implemented the latter, accessible through the VAR class:

In [18]: model.select_order(15)

Out[18]: <statsmodels.tsa.vector_ar.var_model.LagOrderResults at 0x10c89fef0>

When calling the fit function, one can pass a maximum number of lags and the order criterion to use for order selection:

In [19]: results = model.fit(maxlags=15, ic='aic')

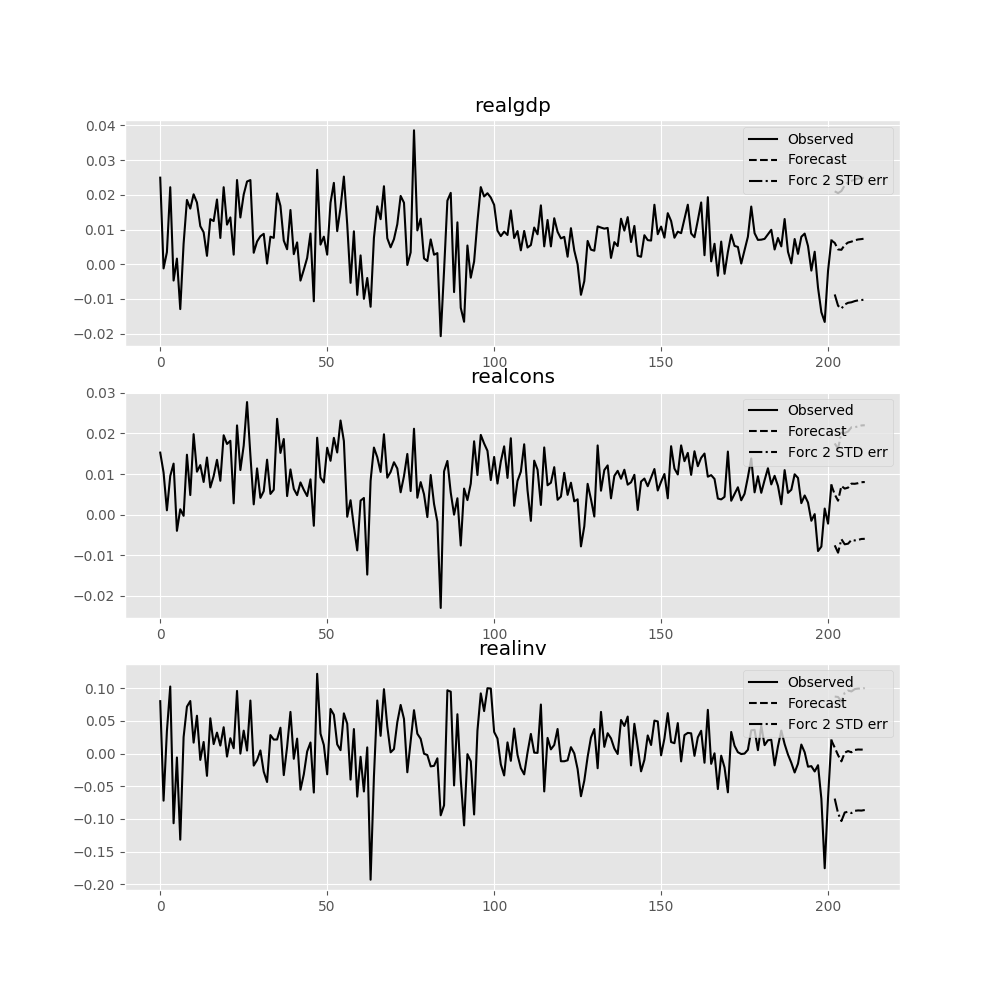

Forecasting¶

The linear predictor is the optimal h-step ahead forecast in terms of mean-squared error:

We can use the forecast function to produce this forecast. Note that we have to specify the “initial value” for the forecast:

In [20]: lag_order = results.k_ar

In [21]: results.forecast(data.values[-lag_order:], 5)

Out[21]:

array([[ 0.0062, 0.005 , 0.0092],

[ 0.0043, 0.0034, -0.0024],

[ 0.0042, 0.0071, -0.0119],

[ 0.0056, 0.0064, 0.0015],

[ 0.0063, 0.0067, 0.0038]])

The forecast_interval function will produce the above forecast along with asymptotic standard errors. These can be visualized using the plot_forecast function:

In [22]: results.plot_forecast(10)

Out[22]: <Figure size 1000x1000 with 3 Axes>

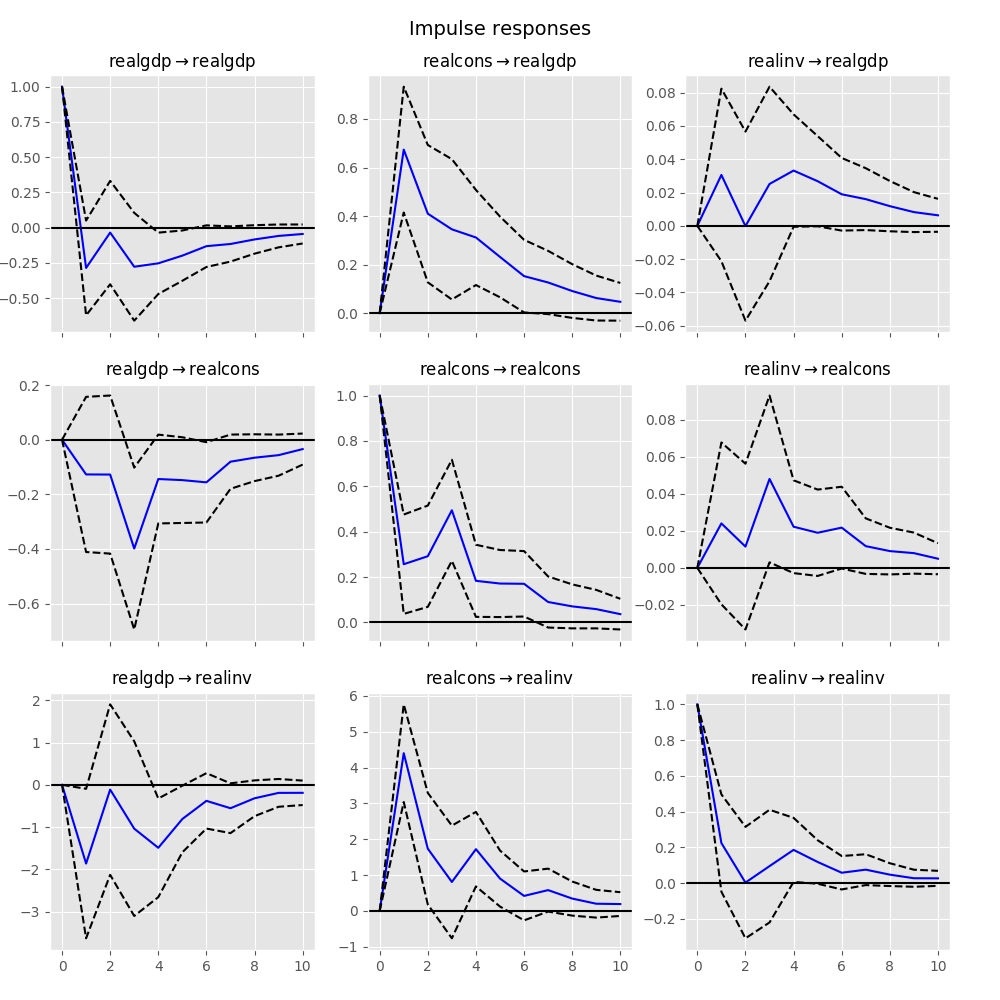

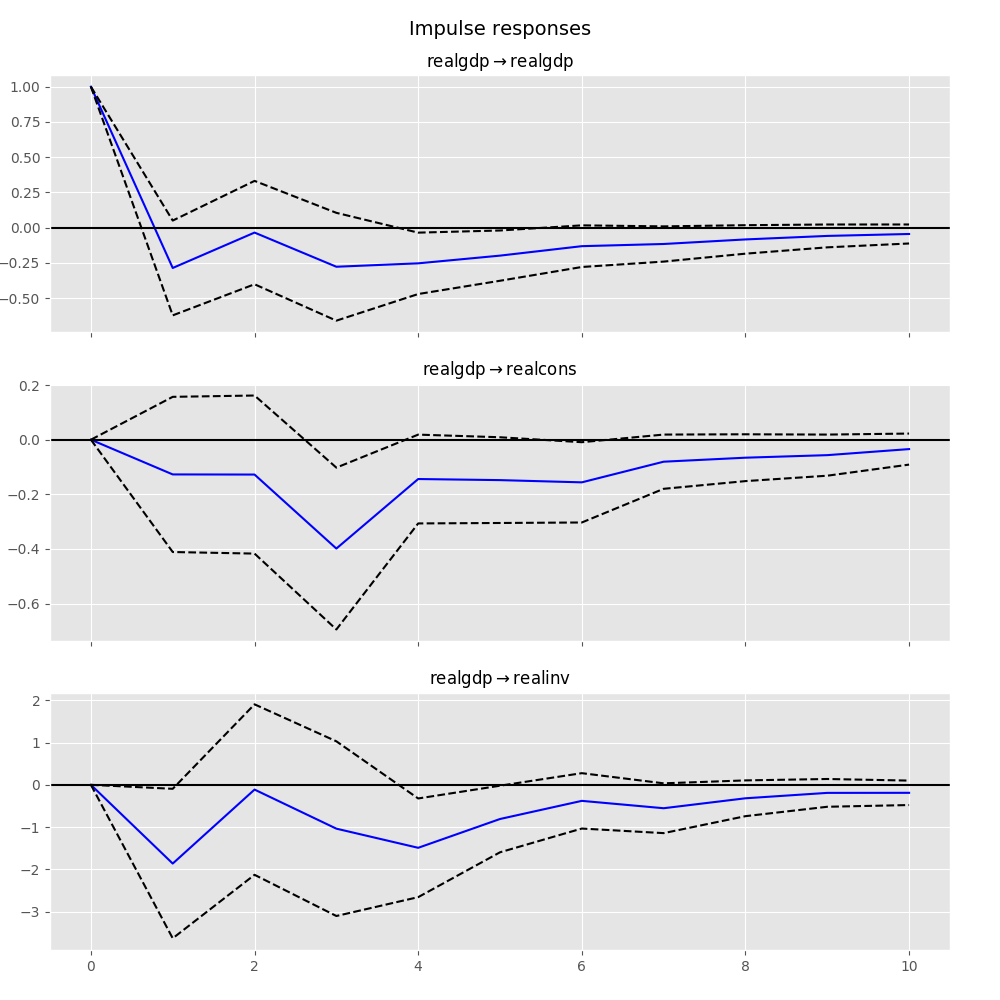

Impulse Response Analysis¶

Impulse responses are of interest in econometric studies: they are the estimated responses to a unit impulse in one of the variables. They are computed in practice using the MA(\(\infty\)) representation of the VAR(p) process:

We can perform an impulse response analysis by calling the irf function on a VARResults object:

In [23]: irf = results.irf(10)

These can be visualized using the plot function, in either orthogonalized or non-orthogonalized form. Asymptotic standard errors are plotted by default at the 95% significance level, which can be modified by the user.

Note

Orthogonalization is done using the Cholesky decomposition of the estimated error covariance matrix \(\hat \Sigma_u\) and hence interpretations may change depending on variable ordering.

In [24]: irf.plot(orth=False)

Out[24]: <Figure size 1000x1000 with 9 Axes>

Note the plot function is flexible and can plot only variables of interest if so desired:

In [25]: irf.plot(impulse='realgdp')

Out[25]: <Figure size 1000x1000 with 3 Axes>

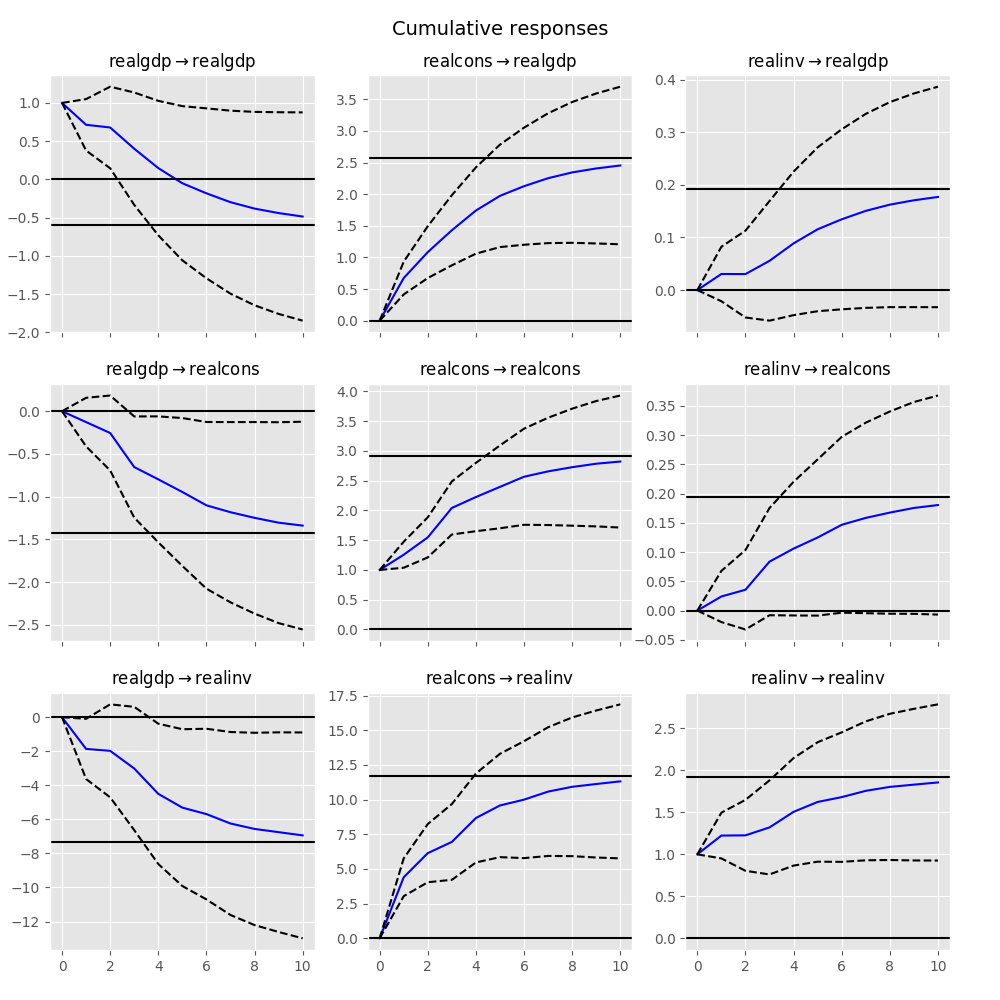

The cumulative effects \(\Psi_n = \sum_{i=0}^n \Phi_i\) can be plotted with the long run effects as follows:

In [26]: irf.plot_cum_effects(orth=False)

Out[26]: <Figure size 1000x1000 with 9 Axes>

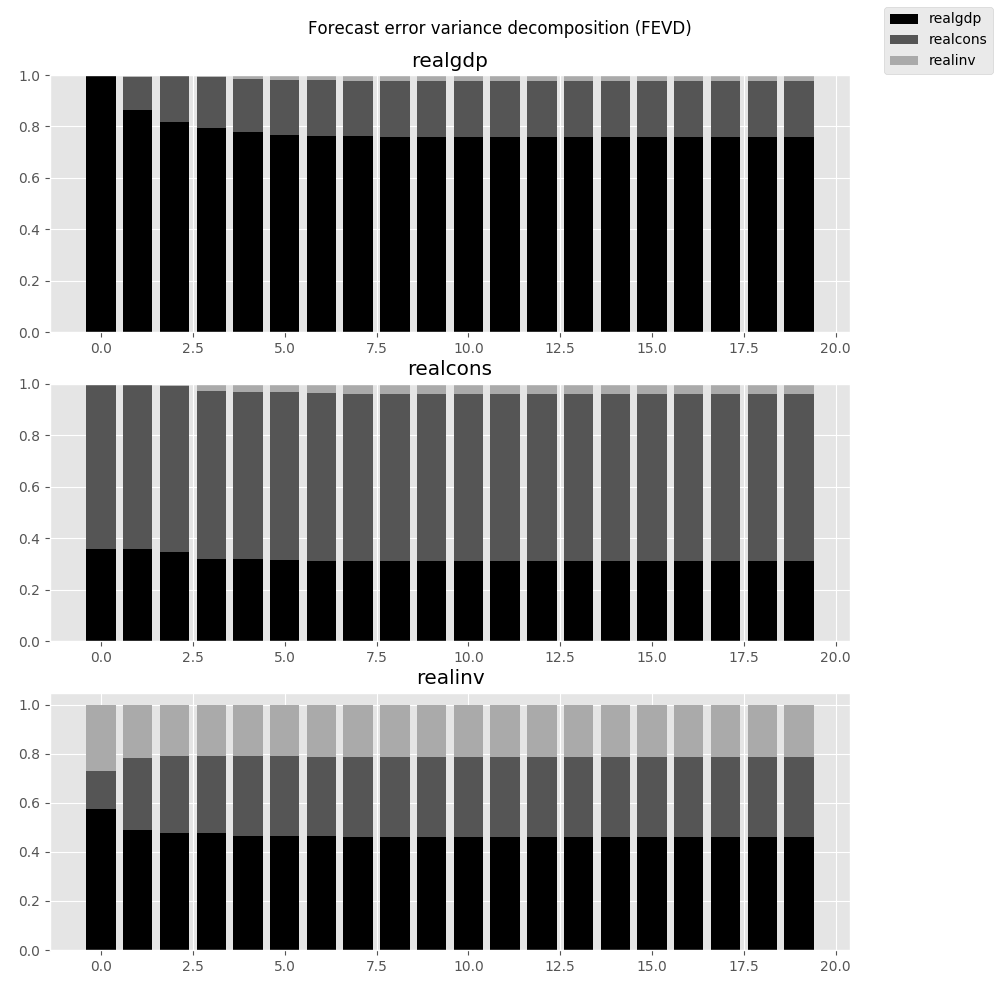

Forecast Error Variance Decomposition (FEVD)¶

Forecast errors of component j on k in an i-step ahead forecast can be decomposed using the orthogonalized impulse responses \(\Theta_i\):

These are computed via the fevd function up through a total number of steps ahead:

In [27]: fevd = results.fevd(5)

In [28]: fevd.summary()

FEVD for realgdp

realgdp realcons realinv

0 1.000000 0.000000 0.000000

1 0.864889 0.129253 0.005858

2 0.816725 0.177898 0.005378

3 0.793647 0.197590 0.008763

4 0.777279 0.208127 0.014594

FEVD for realcons

realgdp realcons realinv

0 0.359877 0.640123 0.000000

1 0.358767 0.635420 0.005813

2 0.348044 0.645138 0.006817

3 0.319913 0.653609 0.026478

4 0.317407 0.652180 0.030414

FEVD for realinv

realgdp realcons realinv

0 0.577021 0.152783 0.270196

1 0.488158 0.293622 0.218220

2 0.478727 0.314398 0.206874

3 0.477182 0.315564 0.207254

4 0.466741 0.324135 0.209124

They can also be visualized through the returned FEVD object:

In [29]: results.fevd(20).plot()

Out[29]: <Figure size 1000x1000 with 3 Axes>

Statistical tests¶

A number of different methods are provided to carry out hypothesis tests about the model results and also the validity of the model assumptions (normality, whiteness / “iid-ness” of errors, etc.).

Granger causality¶

One is often interested in whether a variable or group of variables is “causal”

for another variable, for some definition of “causal”. In the context of VAR

models, one can say that a set of variables are Granger-causal within one of the

VAR equations. We will not detail the mathematics or definition of Granger

causality, but leave it to the reader. The VARResults object has the

test_causality method for performing either a Wald (\(\chi^2\)) test or an

F-test.

In [30]: results.test_causality('realgdp', ['realinv', 'realcons'], kind='f')

Out[30]: <statsmodels.tsa.vector_ar.hypothesis_test_results.CausalityTestResults at 0x10ca15978>

Normality¶

Whiteness of residuals¶

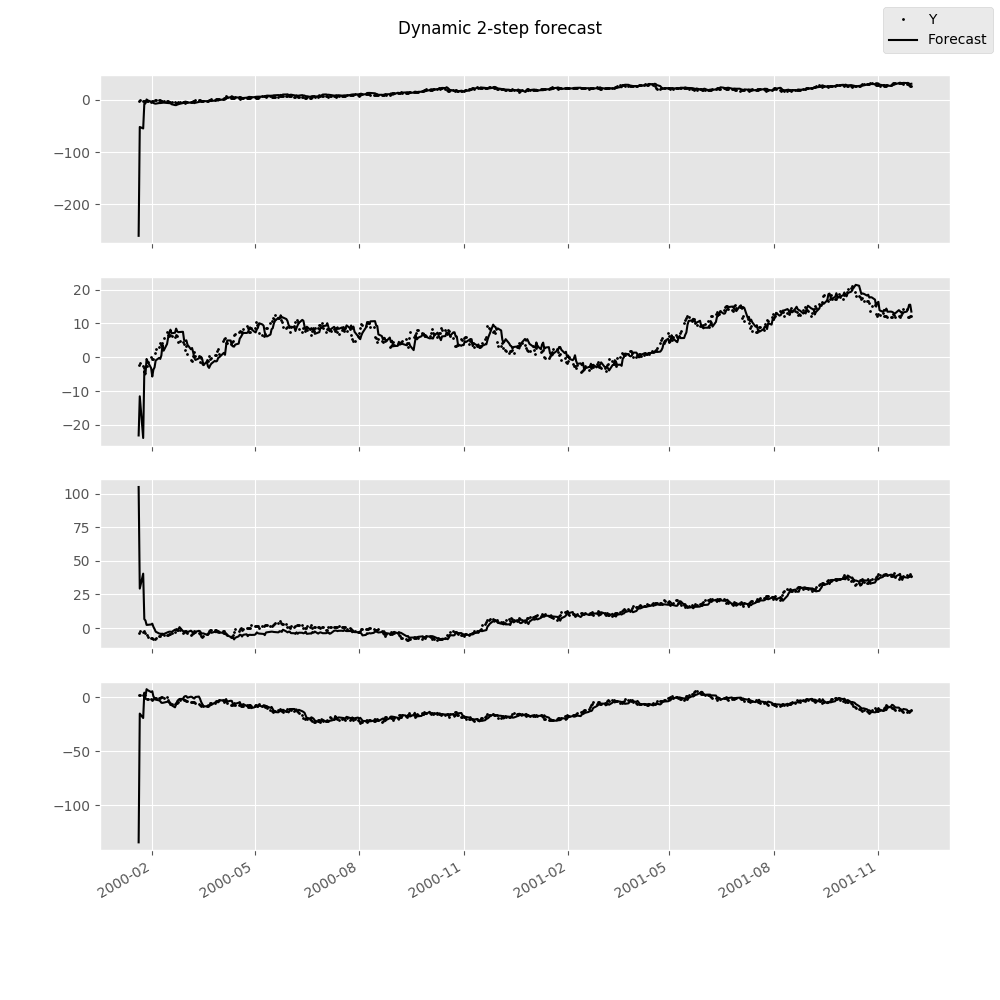

Dynamic Vector Autoregressions¶

Note

To use this functionality, pandas must be installed. See the pandas documentation for more information on the below data structures.

One is often interested in estimating a moving-window regression on time series data for the purposes of making forecasts throughout the data sample. For example, we may wish to produce the series of 2-step-ahead forecasts produced by a VAR(p) model estimated at each point in time.

In [31]: np.random.seed(1)

In [32]: import pandas.util.testing as ptest

In [33]: ptest.N = 500

In [34]: data = ptest.makeTimeDataFrame().cumsum(0)

In [35]: data

Out[35]:

A B C D

2000-01-03 1.624345 -1.719394 -0.153236 1.301225

2000-01-04 1.012589 -1.662273 -2.585745 0.988833

2000-01-05 0.484417 -2.461821 -2.077760 0.717604

2000-01-06 -0.588551 -2.753416 -2.401793 2.580517

2000-01-07 0.276856 -3.012398 -3.912869 1.937644

... ... ... ... ...

2001-11-26 29.552085 14.274036 39.222558 -13.243907

2001-11-27 30.080964 11.996738 38.589968 -12.682989

2001-11-28 27.843878 11.927114 38.380121 -13.604648

2001-11-29 26.736165 12.280984 40.277282 -12.957273

2001-11-30 26.718447 12.094029 38.895890 -11.570447

[500 rows x 4 columns]

In [36]: var = DynamicVAR(data, lag_order=2, window_type='expanding')

The estimated coefficients for the dynamic model are returned as a

pandas.Panel object, which can allow you to easily examine, for

example, all of the model coefficients by equation or by date:

In [37]: import datetime as dt

In [38]: var.coefs

Out[38]:

<class 'pandas.core.panel.Panel'>

Dimensions: 9 (items) x 489 (major_axis) x 4 (minor_axis)

Items axis: L1.A to intercept

Major_axis axis: 2000-01-18 00:00:00 to 2001-11-30 00:00:00

Minor_axis axis: A to D

# all estimated coefficients for equation A

In [39]: var.coefs.minor_xs('A').info()

������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 489 entries, 2000-01-18 to 2001-11-30

Freq: B

Data columns (total 9 columns):

L1.A 489 non-null float64

L1.B 489 non-null float64

L1.C 489 non-null float64

L1.D 489 non-null float64

L2.A 489 non-null float64

L2.B 489 non-null float64

L2.C 489 non-null float64

L2.D 489 non-null float64

intercept 489 non-null float64

dtypes: float64(9)

memory usage: 58.2 KB

# coefficients on 11/30/2001

In [40]: var.coefs.major_xs(dt.datetime(2001, 11, 30)).T

����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������Out[40]:

A B C D

L1.A 0.971964 0.045960 0.003883 0.003822

L1.B 0.043951 0.937964 0.000735 0.020823

L1.C 0.038144 0.018260 0.977037 0.129287

L1.D 0.038618 0.036180 0.052855 1.002657

L2.A 0.013588 -0.046791 0.011558 -0.005300

L2.B -0.048885 0.041853 0.012185 -0.048732

L2.C -0.029426 -0.015238 0.011520 -0.119014

L2.D -0.049945 -0.025419 -0.045621 -0.019496

intercept 0.113331 0.248795 -0.058837 -0.089302

Dynamic forecasts for a given number of steps ahead can be produced using the

forecast function and return a pandas.DataMatrix object:

In [41]: var.forecast(2)

Out[41]:

A B C D

2000-01-20 -260.325888 -23.141610 104.930427 -134.489882

2000-01-21 -52.121483 -11.566786 29.383608 -15.099109

2000-01-24 -54.900049 -23.894858 40.470913 -19.199059

2000-01-25 -7.493484 -4.057529 6.682707 4.301623

2000-01-26 -6.866108 -5.065873 5.623590 0.796081

... ... ... ... ...

2001-11-26 31.886126 13.515527 37.618145 -11.464682

2001-11-27 32.314633 14.237672 37.397691 -12.809727

2001-11-28 30.896528 15.488388 38.541596 -13.129524

2001-11-29 30.077228 15.533337 38.734096 -12.900891

2001-11-30 30.510380 13.491615 38.088228 -12.384976

[487 rows x 4 columns]

The forecasts can be visualized using plot_forecast:

In [42]: var.plot_forecast(2)

Class Reference¶

var_model.VAR(endog[, exog, dates, freq, …]) |

Fit VAR(p) process and do lag order selection |

var_model.VARProcess(coefs, coefs_exog, sigma_u) |

Class represents a known VAR(p) process |

var_model.VARResults(endog, endog_lagged, …) |

Estimate VAR(p) process with fixed number of lags |

irf.IRAnalysis(model[, P, periods, order, …]) |

Impulse response analysis class. |

var_model.FEVD(model[, P, periods]) |

Compute and plot Forecast error variance decomposition and asymptotic standard errors |

dynamic.DynamicVAR(data[, lag_order, …]) |

Estimates time-varying vector autoregression (VAR(p)) using equation-by-equation least squares |