SARIMAX: Introduction¶

This notebook replicates examples from the Stata ARIMA time series estimation and postestimation documentation.

First, we replicate the four estimation examples http://www.stata.com/manuals13/tsarima.pdf:

ARIMA(1,1,1) model on the U.S. Wholesale Price Index (WPI) dataset.

Variation of example 1 which adds an MA(4) term to the ARIMA(1,1,1) specification to allow for an additive seasonal effect.

ARIMA(2,1,0) x (1,1,0,12) model of monthly airline data. This example allows a multiplicative seasonal effect.

ARMA(1,1) model with exogenous regressors; describes consumption as an autoregressive process on which also the money supply is assumed to be an explanatory variable.

Second, we demonstrate postestimation capabilities to replicate http://www.stata.com/manuals13/tsarimapostestimation.pdf. The model from example 4 is used to demonstrate:

One-step-ahead in-sample prediction

n-step-ahead out-of-sample forecasting

n-step-ahead in-sample dynamic prediction

[1]:

%matplotlib inline

[2]:

from datetime import datetime

from io import BytesIO

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import requests

import statsmodels.api as sm

from scipy.stats import norm

# Register converters to avoid warnings

pd.plotting.register_matplotlib_converters()

plt.rc("figure", figsize=(16, 8))

plt.rc("font", size=14)

ARIMA Example 1: Arima¶

As can be seen in the graphs from Example 2, the Wholesale price index (WPI) is growing over time (i.e. is not stationary). Therefore an ARMA model is not a good specification. In this first example, we consider a model where the original time series is assumed to be integrated of order 1, so that the difference is assumed to be stationary, and fit a model with one autoregressive lag and one moving average lag, as well as an intercept term.

The postulated data process is then:

where \(c\) is the intercept of the ARMA model, \(\Delta\) is the first-difference operator, and we assume \(\epsilon_{t} \sim N(0, \sigma^2)\). This can be rewritten to emphasize lag polynomials as (this will be useful in example 2, below):

where \(L\) is the lag operator.

Notice that one difference between the Stata output and the output below is that Stata estimates the following model:

where \(\beta_0\) is the mean of the process \(y_t\). This model is equivalent to the one estimated in the statsmodels SARIMAX class, but the interpretation is different. To see the equivalence, note that:

so that \(c = (1 - \phi_1) \beta_0\).

[3]:

# Dataset

wpi1 = requests.get("https://www.stata-press.com/data/r12/wpi1.dta").content

data = pd.read_stata(BytesIO(wpi1))

data.index = data.t

# Set the frequency

data.index.freq = "QS-OCT"

# Fit the model

mod = sm.tsa.statespace.SARIMAX(data["wpi"], trend="c", order=(1, 1, 1))

res = mod.fit(disp=False)

print(res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 1, 1) Log Likelihood -135.351

Date: Tue, 13 Jan 2026 AIC 278.703

Time: 23:47:54 BIC 289.951

Sample: 01-01-1960 HQIC 283.272

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0943 0.068 1.389 0.165 -0.039 0.227

ar.L1 0.8742 0.055 16.028 0.000 0.767 0.981

ma.L1 -0.4120 0.100 -4.119 0.000 -0.608 -0.216

sigma2 0.5257 0.053 9.849 0.000 0.421 0.630

===================================================================================

Ljung-Box (L1) (Q): 0.09 Jarque-Bera (JB): 9.78

Prob(Q): 0.77 Prob(JB): 0.01

Heteroskedasticity (H): 15.93 Skew: 0.28

Prob(H) (two-sided): 0.00 Kurtosis: 4.26

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Thus the maximum likelihood estimates imply that for the process above, we have:

where \(\epsilon_{t} \sim N(0, 0.5257)\). Finally, recall that \(c = (1 - \phi_1) \beta_0\), and here \(c = 0.0943\) and \(\phi_1 = 0.8742\). To compare with the output from Stata, we could calculate the mean:

Note: This value is virtually identical to the value in the Stata documentation, \(\beta_0 = 0.7498\). The slight difference is likely down to rounding and subtle differences in stopping criterion of the numerical optimizers used.

ARIMA Example 2: Arima with additive seasonal effects¶

This model is an extension of that from example 1. Here the data is assumed to follow the process:

The new part of this model is that there is allowed to be a annual seasonal effect (it is annual even though the periodicity is 4 because the dataset is quarterly). The second difference is that this model uses the log of the data rather than the level.

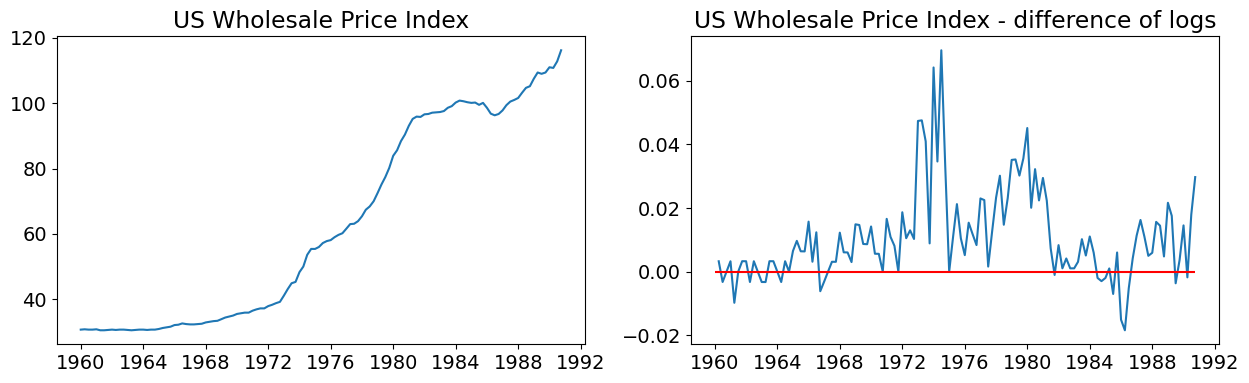

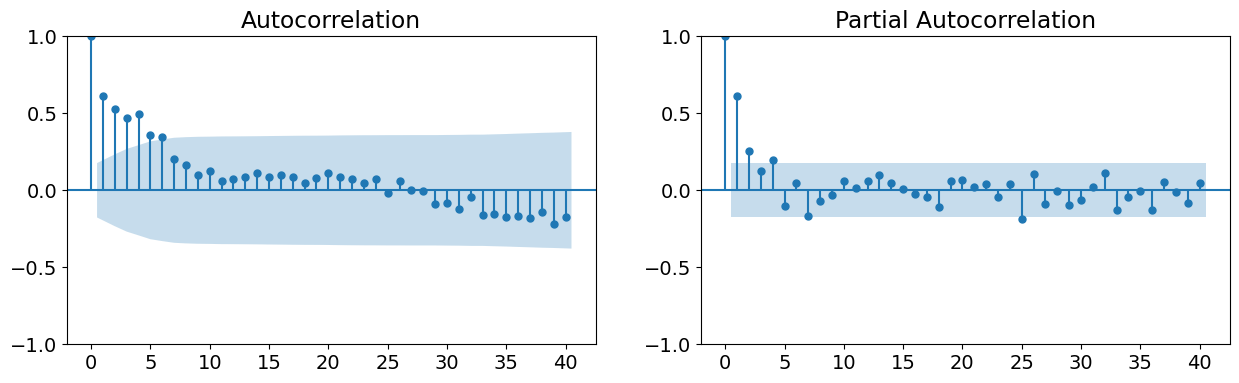

Before estimating the dataset, graphs showing:

The time series (in logs)

The first difference of the time series (in logs)

The autocorrelation function

The partial autocorrelation function.

From the first two graphs, we note that the original time series does not appear to be stationary, whereas the first-difference does. This supports either estimating an ARMA model on the first-difference of the data, or estimating an ARIMA model with 1 order of integration (recall that we are taking the latter approach). The last two graphs support the use of an ARMA(1,1,1) model.

[4]:

# Dataset

data = pd.read_stata(BytesIO(wpi1))

data.index = data.t

data.index.freq = "QS-OCT"

data["ln_wpi"] = np.log(data["wpi"])

data["D.ln_wpi"] = data["ln_wpi"].diff()

[5]:

# Graph data

fig, axes = plt.subplots(1, 2, figsize=(15, 4))

# Levels

axes[0].plot(data.index._mpl_repr(), data["wpi"], "-")

axes[0].set(title="US Wholesale Price Index")

# Log difference

axes[1].plot(data.index._mpl_repr(), data["D.ln_wpi"], "-")

axes[1].hlines(0, data.index[0], data.index[-1], "r")

axes[1].set(title="US Wholesale Price Index - difference of logs");

[6]:

# Graph data

fig, axes = plt.subplots(1, 2, figsize=(15, 4))

fig = sm.graphics.tsa.plot_acf(data.iloc[1:]["D.ln_wpi"], lags=40, ax=axes[0])

fig = sm.graphics.tsa.plot_pacf(data.iloc[1:]["D.ln_wpi"], lags=40, ax=axes[1])

To understand how to specify this model in statsmodels, first recall that from example 1 we used the following code to specify the ARIMA(1,1,1) model:

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(1,1,1))

The order argument is a tuple of the form (AR specification, Integration order, MA specification). The integration order must be an integer (for example, here we assumed one order of integration, so it was specified as 1. In a pure ARMA model where the underlying data is already stationary, it would be 0).

For the AR specification and MA specification components, there are two possibilities. The first is to specify the maximum degree of the corresponding lag polynomial, in which case the component is an integer. For example, if we wanted to specify an ARIMA(1,1,4) process, we would use:

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(1,1,4))

and the corresponding data process would be:

or

When the specification parameter is given as a maximum degree of the lag polynomial, it implies that all polynomial terms up to that degree are included. Notice that this is not the model we want to use, because it would include terms for \(\epsilon_{t-2}\) and \(\epsilon_{t-3}\), which we do not want here.

What we want is a polynomial that has terms for the 1st and 4th degrees, but leaves out the 2nd and 3rd terms. To do that, we need to provide a tuple for the specification parameter, where the tuple describes the lag polynomial itself. In particular, here we would want to use:

ar = 1 # this is the maximum degree specification

ma = (1,0,0,1) # this is the lag polynomial specification

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(ar,1,ma)))

This gives the following form for the process of the data:

which is what we want.

[7]:

# Fit the model

mod = sm.tsa.statespace.SARIMAX(data["ln_wpi"], trend="c", order=(1, 1, (1, 0, 0, 1)))

res = mod.fit(disp=False)

print(res.summary())

SARIMAX Results

=================================================================================

Dep. Variable: ln_wpi No. Observations: 124

Model: SARIMAX(1, 1, [1, 4]) Log Likelihood 386.033

Date: Tue, 13 Jan 2026 AIC -762.067

Time: 23:48:04 BIC -748.006

Sample: 01-01-1960 HQIC -756.355

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0024 0.002 1.481 0.139 -0.001 0.006

ar.L1 0.7817 0.094 8.296 0.000 0.597 0.966

ma.L1 -0.3991 0.126 -3.174 0.002 -0.645 -0.153

ma.L4 0.3083 0.120 2.569 0.010 0.073 0.543

sigma2 0.0001 9.8e-06 11.109 0.000 8.97e-05 0.000

===================================================================================

Ljung-Box (L1) (Q): 0.01 Jarque-Bera (JB): 45.25

Prob(Q): 0.91 Prob(JB): 0.00

Heteroskedasticity (H): 2.58 Skew: 0.28

Prob(H) (two-sided): 0.00 Kurtosis: 5.92

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

ARIMA Example 3: Airline Model¶

In the previous example, we included a seasonal effect in an additive way, meaning that we added a term allowing the process to depend on the 4th MA lag. It may be instead that we want to model a seasonal effect in a multiplicative way. We often write the model then as an ARIMA \((p,d,q) \times (P,D,Q)_s\), where the lowercase letters indicate the specification for the non-seasonal component, and the uppercase letters indicate the specification for the seasonal component; \(s\) is the periodicity of the seasons (e.g. it is often 4 for quarterly data or 12 for monthly data). The data process can be written generically as:

where:

\(\phi_p (L)\) is the non-seasonal autoregressive lag polynomial

\(\tilde \phi_P (L^s)\) is the seasonal autoregressive lag polynomial

\(\Delta^d \Delta_s^D y_t\) is the time series, differenced \(d\) times, and seasonally differenced \(D\) times.

\(A(t)\) is the trend polynomial (including the intercept)

\(\theta_q (L)\) is the non-seasonal moving average lag polynomial

\(\tilde \theta_Q (L^s)\) is the seasonal moving average lag polynomial

sometimes we rewrite this as:

where \(y_t^* = \Delta^d \Delta_s^D y_t\). This emphasizes that just as in the simple case, after we take differences (here both non-seasonal and seasonal) to make the data stationary, the resulting model is just an ARMA model.

As an example, consider the airline model ARIMA \((2,1,0) \times (1,1,0)_{12}\), with an intercept. The data process can be written in the form above as:

Here, we have:

\(\phi_p (L) = (1 - \phi_1 L - \phi_2 L^2)\)

\(\tilde \phi_P (L^s) = (1 - \phi_1 L^12)\)

\(d = 1, D = 1, s=12\) indicating that \(y_t^*\) is derived from \(y_t\) by taking first-differences and then taking 12-th differences.

\(A(t) = c\) is the constant trend polynomial (i.e. just an intercept)

\(\theta_q (L) = \tilde \theta_Q (L^s) = 1\) (i.e. there is no moving average effect)

It may still be confusing to see the two lag polynomials in front of the time-series variable, but notice that we can multiply the lag polynomials together to get the following model:

which can be rewritten as:

This is similar to the additively seasonal model from example 2, but the coefficients in front of the autoregressive lags are actually combinations of the underlying seasonal and non-seasonal parameters.

Specifying the model in statsmodels is done simply by adding the seasonal_order argument, which accepts a tuple of the form (Seasonal AR specification, Seasonal Integration order, Seasonal MA, Seasonal periodicity). The seasonal AR and MA specifications, as before, can be expressed as a maximum polynomial degree or as the lag polynomial itself. Seasonal periodicity is an integer.

For the airline model ARIMA \((2,1,0) \times (1,1,0)_{12}\) with an intercept, the command is:

mod = sm.tsa.statespace.SARIMAX(data['lnair'], order=(2,1,0), seasonal_order=(1,1,0,12))

[8]:

# Dataset

air2 = requests.get("https://www.stata-press.com/data/r12/air2.dta").content

data = pd.read_stata(BytesIO(air2))

data.index = pd.date_range(

start=datetime(int(data.time[0]), 1, 1), periods=len(data), freq="MS"

)

data["lnair"] = np.log(data["air"])

# Fit the model

mod = sm.tsa.statespace.SARIMAX(

data["lnair"],

order=(2, 1, 0),

seasonal_order=(1, 1, 0, 12),

simple_differencing=True,

)

res = mod.fit(disp=False)

print(res.summary())

SARIMAX Results

==========================================================================================

Dep. Variable: D.DS12.lnair No. Observations: 131

Model: SARIMAX(2, 0, 0)x(1, 0, 0, 12) Log Likelihood 240.821

Date: Tue, 13 Jan 2026 AIC -473.643

Time: 23:48:10 BIC -462.142

Sample: 02-01-1950 HQIC -468.970

- 12-01-1960

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.4057 0.080 -5.045 0.000 -0.563 -0.248

ar.L2 -0.0799 0.099 -0.809 0.419 -0.274 0.114

ar.S.L12 -0.4723 0.072 -6.592 0.000 -0.613 -0.332

sigma2 0.0014 0.000 8.403 0.000 0.001 0.002

===================================================================================

Ljung-Box (L1) (Q): 0.01 Jarque-Bera (JB): 0.72

Prob(Q): 0.91 Prob(JB): 0.70

Heteroskedasticity (H): 0.54 Skew: 0.14

Prob(H) (two-sided): 0.04 Kurtosis: 3.23

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Notice that here we used an additional argument simple_differencing=True. This controls how the order of integration is handled in ARIMA models. If simple_differencing=True, then the time series provided as endog is literally differenced and an ARMA model is fit to the resulting new time series. This implies that a number of initial periods are lost to the differencing process, however it may be necessary either to compare results to other packages (e.g. Stata’s arima always uses

simple differencing) or if the seasonal periodicity is large.

The default is simple_differencing=False, in which case the integration component is implemented as part of the state space formulation, and all of the original data can be used in estimation.

ARIMA Example 4: ARMAX (Friedman)¶

This model demonstrates the use of explanatory variables (the X part of ARMAX). When exogenous regressors are included, the SARIMAX module uses the concept of “regression with SARIMA errors” (see http://robjhyndman.com/hyndsight/arimax/ for details of regression with ARIMA errors versus alternative specifications), so that the model is specified as:

Notice that the first equation is just a linear regression, and the second equation just describes the process followed by the error component as SARIMA (as was described in example 3). One reason for this specification is that the estimated parameters have their natural interpretations.

This specification nests many simpler specifications. For example, regression with AR(2) errors is:

The model considered in this example is regression with ARMA(1,1) errors. The process is then written:

Notice that \(\beta_0\) is, as described in example 1 above, not the same thing as an intercept specified by trend='c'. Whereas in the examples above we estimated the intercept of the model via the trend polynomial, here, we demonstrate how to estimate \(\beta_0\) itself by adding a constant to the exogenous dataset. In the output, the \(beta_0\) is called const, whereas above the intercept \(c\) was called intercept in the output.

[9]:

# Dataset

friedman2 = requests.get("https://www.stata-press.com/data/r12/friedman2.dta").content

data = pd.read_stata(BytesIO(friedman2))

data.index = data.time

data.index.freq = "QS-OCT"

# Variables

endog = data.loc["1959":"1981", "consump"]

exog = sm.add_constant(data.loc["1959":"1981", "m2"])

# Fit the model

mod = sm.tsa.statespace.SARIMAX(endog, exog, order=(1, 0, 1))

res = mod.fit(disp=False)

print(res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: consump No. Observations: 92

Model: SARIMAX(1, 0, 1) Log Likelihood -340.508

Date: Tue, 13 Jan 2026 AIC 691.015

Time: 23:48:12 BIC 703.624

Sample: 01-01-1959 HQIC 696.105

- 10-01-1981

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -36.0605 56.643 -0.637 0.524 -147.079 74.958

m2 1.1220 0.036 30.824 0.000 1.051 1.193

ar.L1 0.9348 0.041 22.717 0.000 0.854 1.016

ma.L1 0.3091 0.089 3.488 0.000 0.135 0.483

sigma2 93.2556 10.889 8.565 0.000 71.914 114.597

===================================================================================

Ljung-Box (L1) (Q): 0.04 Jarque-Bera (JB): 23.49

Prob(Q): 0.84 Prob(JB): 0.00

Heteroskedasticity (H): 22.51 Skew: 0.17

Prob(H) (two-sided): 0.00 Kurtosis: 5.45

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

ARIMA Postestimation: Example 1 - Dynamic Forecasting¶

Here we describe some of the post-estimation capabilities of statsmodels’ SARIMAX.

First, using the model from example, we estimate the parameters using data that excludes the last few observations (this is a little artificial as an example, but it allows considering performance of out-of-sample forecasting and facilitates comparison to Stata’s documentation).

[10]:

# Dataset

raw = pd.read_stata(BytesIO(friedman2))

raw.index = raw.time

raw.index.freq = "QS-OCT"

data = raw.loc[:"1981"]

# Variables

endog = data.loc["1959":, "consump"]

exog = sm.add_constant(data.loc["1959":, "m2"])

nobs = endog.shape[0]

# Fit the model

mod = sm.tsa.statespace.SARIMAX(

endog.loc[:"1978-01-01"], exog=exog.loc[:"1978-01-01"], order=(1, 0, 1)

)

fit_res = mod.fit(disp=False, maxiter=250)

print(fit_res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: consump No. Observations: 77

Model: SARIMAX(1, 0, 1) Log Likelihood -243.316

Date: Tue, 13 Jan 2026 AIC 496.633

Time: 23:48:13 BIC 508.352

Sample: 01-01-1959 HQIC 501.320

- 01-01-1978

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.6775 18.492 0.037 0.971 -35.567 36.922

m2 1.0379 0.021 50.328 0.000 0.997 1.078

ar.L1 0.8775 0.059 14.859 0.000 0.762 0.993

ma.L1 0.2771 0.108 2.571 0.010 0.066 0.488

sigma2 31.6991 4.683 6.769 0.000 22.520 40.878

===================================================================================

Ljung-Box (L1) (Q): 0.32 Jarque-Bera (JB): 6.05

Prob(Q): 0.57 Prob(JB): 0.05

Heteroskedasticity (H): 6.09 Skew: 0.57

Prob(H) (two-sided): 0.00 Kurtosis: 3.76

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Next, we want to get results for the full dataset but using the estimated parameters (on a subset of the data).

[11]:

mod = sm.tsa.statespace.SARIMAX(endog, exog=exog, order=(1, 0, 1))

res = mod.filter(fit_res.params)

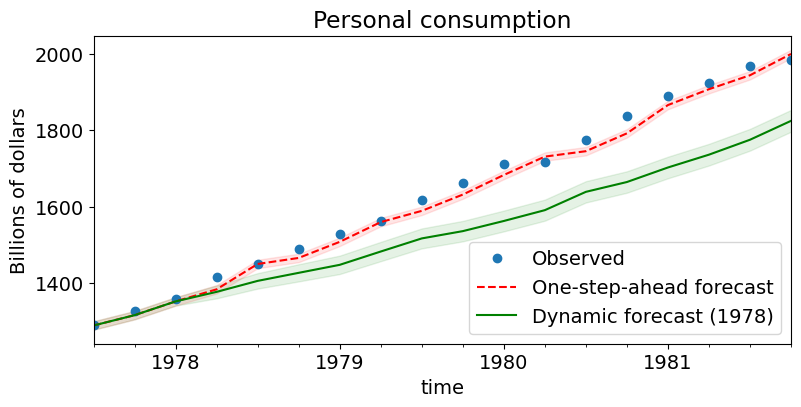

The predict command is first applied here to get in-sample predictions. We use the full_results=True argument to allow us to calculate confidence intervals (the default output of predict is just the predicted values).

With no other arguments, predict returns the one-step-ahead in-sample predictions for the entire sample.

[12]:

# In-sample one-step-ahead predictions

predict = res.get_prediction()

predict_ci = predict.conf_int()

We can also get dynamic predictions. One-step-ahead prediction uses the true values of the endogenous values at each step to predict the next in-sample value. Dynamic predictions use one-step-ahead prediction up to some point in the dataset (specified by the dynamic argument); after that, the previous predicted endogenous values are used in place of the true endogenous values for each new predicted element.

The dynamic argument is specified to be an offset relative to the start argument. If start is not specified, it is assumed to be 0.

Here we perform dynamic prediction starting in the first quarter of 1978.

[13]:

# Dynamic predictions

predict_dy = res.get_prediction(dynamic="1978-01-01")

predict_dy_ci = predict_dy.conf_int()

We can graph the one-step-ahead and dynamic predictions (and the corresponding confidence intervals) to see their relative performance. Notice that up to the point where dynamic prediction begins (1978:Q1), the two are the same.

[14]:

# Graph

fig, ax = plt.subplots(figsize=(9, 4))

npre = 4

ax.set(title="Personal consumption", xlabel="Date", ylabel="Billions of dollars")

# Plot data points

data.loc["1977-07-01":, "consump"].plot(ax=ax, style="o", label="Observed")

# Plot predictions

predict.predicted_mean.loc["1977-07-01":].plot(

ax=ax, style="r--", label="One-step-ahead forecast"

)

ci = predict_ci.loc["1977-07-01":]

ax.fill_between(ci.index, ci.iloc[:, 0], ci.iloc[:, 1], color="r", alpha=0.1)

predict_dy.predicted_mean.loc["1977-07-01":].plot(

ax=ax, style="g", label="Dynamic forecast (1978)"

)

ci = predict_dy_ci.loc["1977-07-01":]

ax.fill_between(ci.index, ci.iloc[:, 0], ci.iloc[:, 1], color="g", alpha=0.1)

legend = ax.legend(loc="lower right")

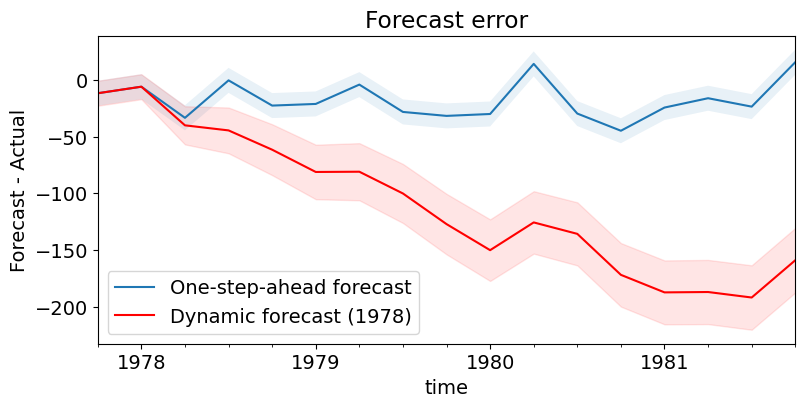

Finally, graph the prediction error. It is obvious that, as one would suspect, one-step-ahead prediction is considerably better.

[15]:

# Prediction error

# Graph

fig, ax = plt.subplots(figsize=(9, 4))

npre = 4

ax.set(title="Forecast error", xlabel="Date", ylabel="Forecast - Actual")

# In-sample one-step-ahead predictions and 95% confidence intervals

predict_error = predict.predicted_mean - endog

predict_error.loc["1977-10-01":].plot(ax=ax, label="One-step-ahead forecast")

ci = predict_ci.loc["1977-10-01":].copy()

ci.iloc[:, 0] -= endog.loc["1977-10-01":]

ci.iloc[:, 1] -= endog.loc["1977-10-01":]

ax.fill_between(ci.index, ci.iloc[:, 0], ci.iloc[:, 1], alpha=0.1)

# Dynamic predictions and 95% confidence intervals

predict_dy_error = predict_dy.predicted_mean - endog

predict_dy_error.loc["1977-10-01":].plot(

ax=ax, style="r", label="Dynamic forecast (1978)"

)

ci = predict_dy_ci.loc["1977-10-01":].copy()

ci.iloc[:, 0] -= endog.loc["1977-10-01":]

ci.iloc[:, 1] -= endog.loc["1977-10-01":]

ax.fill_between(ci.index, ci.iloc[:, 0], ci.iloc[:, 1], color="r", alpha=0.1)

legend = ax.legend(loc="lower left")

legend.get_frame().set_facecolor("w")