Autoregressions¶

This notebook introduces autoregression modeling using the AutoReg model. It also covers aspects of ar_select_order assists in selecting models that minimize an information criteria such as the AIC. An autoregressive model has dynamics given by

AutoReg also permits models with:

Deterministic terms (

trend)n: No deterministic termc: Constant (default)ct: Constant and time trendt: Time trend only

Seasonal dummies (

seasonal)Trueincludes \(s-1\) dummies where \(s\) is the period of the time series (e.g., 12 for monthly)

Custom deterministic terms (

deterministic)Accepts a

DeterministicProcess

Exogenous variables (

exog)A

DataFrameorarrayof exogenous variables to include in the model

Omission of selected lags (

lags)If

lagsis an iterable of integers, then only these are included in the model.

The complete specification is

where:

\(d_i\) is a seasonal dummy that is 1 if \(mod(t, period) = i\). Period 0 is excluded if the model contains a constant (

cis intrend).\(t\) is a time trend (\(1,2,\ldots\)) that starts with 1 in the first observation.

\(x_{t,j}\) are exogenous regressors. Note these are time-aligned to the left-hand-side variable when defining a model.

\(\epsilon_t\) is assumed to be a white noise process.

This first cell imports standard packages and sets plots to appear inline.

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

import pandas as pd

import seaborn as sns

from statsmodels.tsa.api import acf, graphics, pacf

from statsmodels.tsa.ar_model import AutoReg, ar_select_order

This cell sets the plotting style, registers pandas date converters for matplotlib, and sets the default figure size.

[2]:

sns.set_style("darkgrid")

pd.plotting.register_matplotlib_converters()

# Default figure size

sns.mpl.rc("figure", figsize=(16, 6))

sns.mpl.rc("font", size=14)

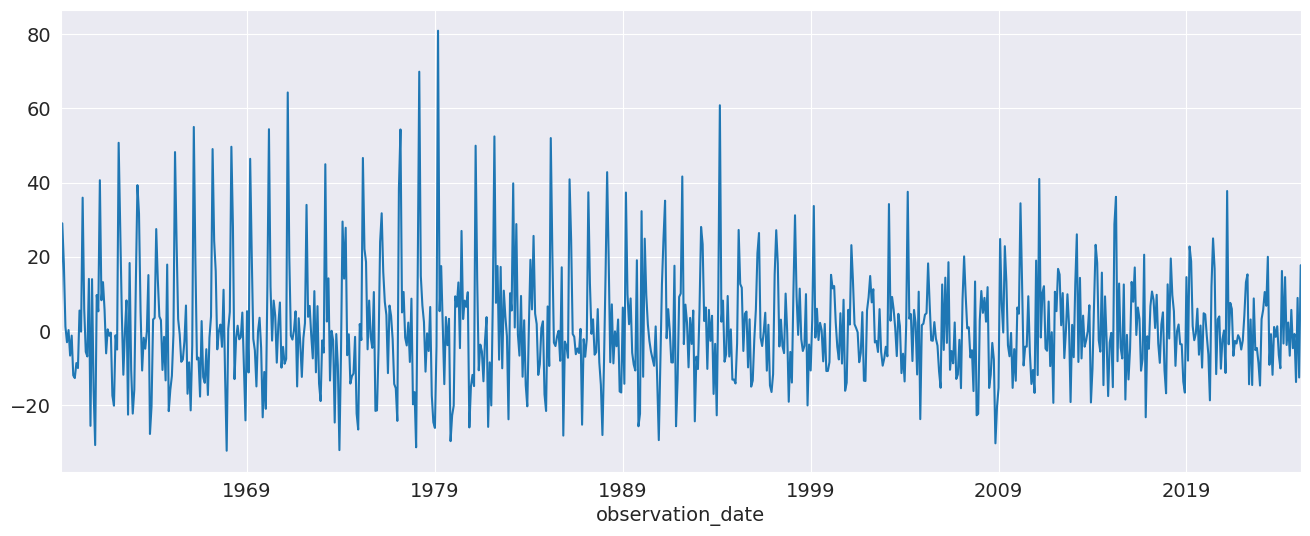

The first set of examples uses the month-over-month growth rate in U.S. Housing starts that has not been seasonally adjusted. The seasonality is evident by the regular pattern of peaks and troughs. We set the frequency for the time series to “MS” (month-start) to avoid warnings when using AutoReg.

[3]:

data_loc = "https://raw.githubusercontent.com/statsmodels/smdatasets/refs/heads/main/data/autoregressions/HOUSTNSA.csv"

housing_data = pd.read_csv(

data_loc,

index_col=0,

parse_dates=True,

)

housing = housing_data.HOUSTNSA.pct_change().dropna()

# Scale by 100 to get percentages

housing = 100 * housing.asfreq("MS")

fig, ax = plt.subplots()

ax = housing.plot(ax=ax)

We can start with an AR(3). While this is not a good model for this data, it demonstrates the basic use of the API.

[4]:

mod = AutoReg(housing, 3, old_names=False)

res = mod.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 793

Model: AutoReg(3) Log Likelihood -3256.705

Method: Conditional MLE S.D. of innovations 14.932

Date: Tue, 13 Jan 2026 AIC 6523.410

Time: 23:53:20 BIC 6546.771

Sample: 05-01-1959 HQIC 6532.390

- 02-01-2025

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.0817 0.534 2.024 0.043 0.034 2.129

HOUSTNSA.L1 0.1781 0.035 5.104 0.000 0.110 0.246

HOUSTNSA.L2 0.0131 0.035 0.369 0.712 -0.056 0.083

HOUSTNSA.L3 -0.1983 0.035 -5.691 0.000 -0.267 -0.130

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9655 -1.3309j 1.6443 -0.1501

AR.2 0.9655 +1.3309j 1.6443 0.1501

AR.3 -1.8651 -0.0000j 1.8651 -0.5000

-----------------------------------------------------------------------------

AutoReg supports the same covariance estimators as OLS. Below, we use cov_type="HC0", which is White’s covariance estimator. While the parameter estimates are the same, all of the quantities that depend on the standard error change.

[5]:

res = mod.fit(cov_type="HC0")

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 793

Model: AutoReg(3) Log Likelihood -3256.705

Method: Conditional MLE S.D. of innovations 14.932

Date: Tue, 13 Jan 2026 AIC 6523.410

Time: 23:53:20 BIC 6546.771

Sample: 05-01-1959 HQIC 6532.390

- 02-01-2025

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.0817 0.560 1.932 0.053 -0.016 2.179

HOUSTNSA.L1 0.1781 0.034 5.275 0.000 0.112 0.244

HOUSTNSA.L2 0.0131 0.037 0.353 0.724 -0.060 0.086

HOUSTNSA.L3 -0.1983 0.034 -5.759 0.000 -0.266 -0.131

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9655 -1.3309j 1.6443 -0.1501

AR.2 0.9655 +1.3309j 1.6443 0.1501

AR.3 -1.8651 -0.0000j 1.8651 -0.5000

-----------------------------------------------------------------------------

[6]:

sel = ar_select_order(housing, 13, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 793

Model: AutoReg(13) Log Likelihood -2939.564

Method: Conditional MLE S.D. of innovations 10.483

Date: Tue, 13 Jan 2026 AIC 5909.128

Time: 23:53:20 BIC 5979.017

Sample: 03-01-1960 HQIC 5936.008

- 02-01-2025

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 1.4235 0.441 3.231 0.001 0.560 2.287

HOUSTNSA.L1 -0.2728 0.034 -7.983 0.000 -0.340 -0.206

HOUSTNSA.L2 -0.0799 0.031 -2.611 0.009 -0.140 -0.020

HOUSTNSA.L3 -0.0911 0.031 -2.986 0.003 -0.151 -0.031

HOUSTNSA.L4 -0.1700 0.030 -5.585 0.000 -0.230 -0.110

HOUSTNSA.L5 -0.0461 0.031 -1.494 0.135 -0.107 0.014

HOUSTNSA.L6 -0.0886 0.030 -2.917 0.004 -0.148 -0.029

HOUSTNSA.L7 -0.0731 0.030 -2.404 0.016 -0.133 -0.013

HOUSTNSA.L8 -0.1580 0.030 -5.205 0.000 -0.218 -0.099

HOUSTNSA.L9 -0.0908 0.031 -2.945 0.003 -0.151 -0.030

HOUSTNSA.L10 -0.1087 0.030 -3.577 0.000 -0.168 -0.049

HOUSTNSA.L11 0.1031 0.030 3.383 0.001 0.043 0.163

HOUSTNSA.L12 0.5023 0.031 16.435 0.000 0.442 0.562

HOUSTNSA.L13 0.2998 0.034 8.767 0.000 0.233 0.367

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 1.1031 -0.0000j 1.1031 -0.0000

AR.2 0.8752 -0.5033j 1.0096 -0.0831

AR.3 0.8752 +0.5033j 1.0096 0.0831

AR.4 0.5050 -0.8785j 1.0133 -0.1670

AR.5 0.5050 +0.8785j 1.0133 0.1670

AR.6 0.0131 -1.0593j 1.0593 -0.2480

AR.7 0.0131 +1.0593j 1.0593 0.2480

AR.8 -0.5279 -0.9390j 1.0772 -0.3315

AR.9 -0.5279 +0.9390j 1.0772 0.3315

AR.10 -0.9597 -0.5922j 1.1277 -0.4120

AR.11 -0.9597 +0.5922j 1.1277 0.4120

AR.12 -1.2951 -0.2595j 1.3208 -0.4685

AR.13 -1.2951 +0.2595j 1.3208 0.4685

------------------------------------------------------------------------------

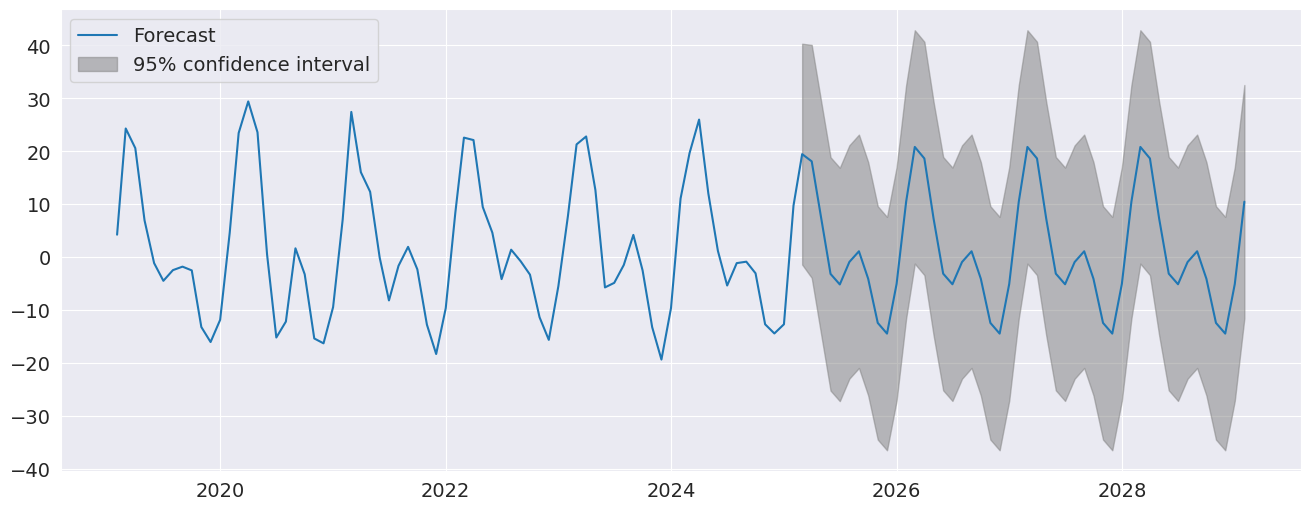

plot_predict visualizes forecasts. Here we produce a large number of forecasts which show the string seasonality captured by the model.

[7]:

fig = res.plot_predict(720, 840)

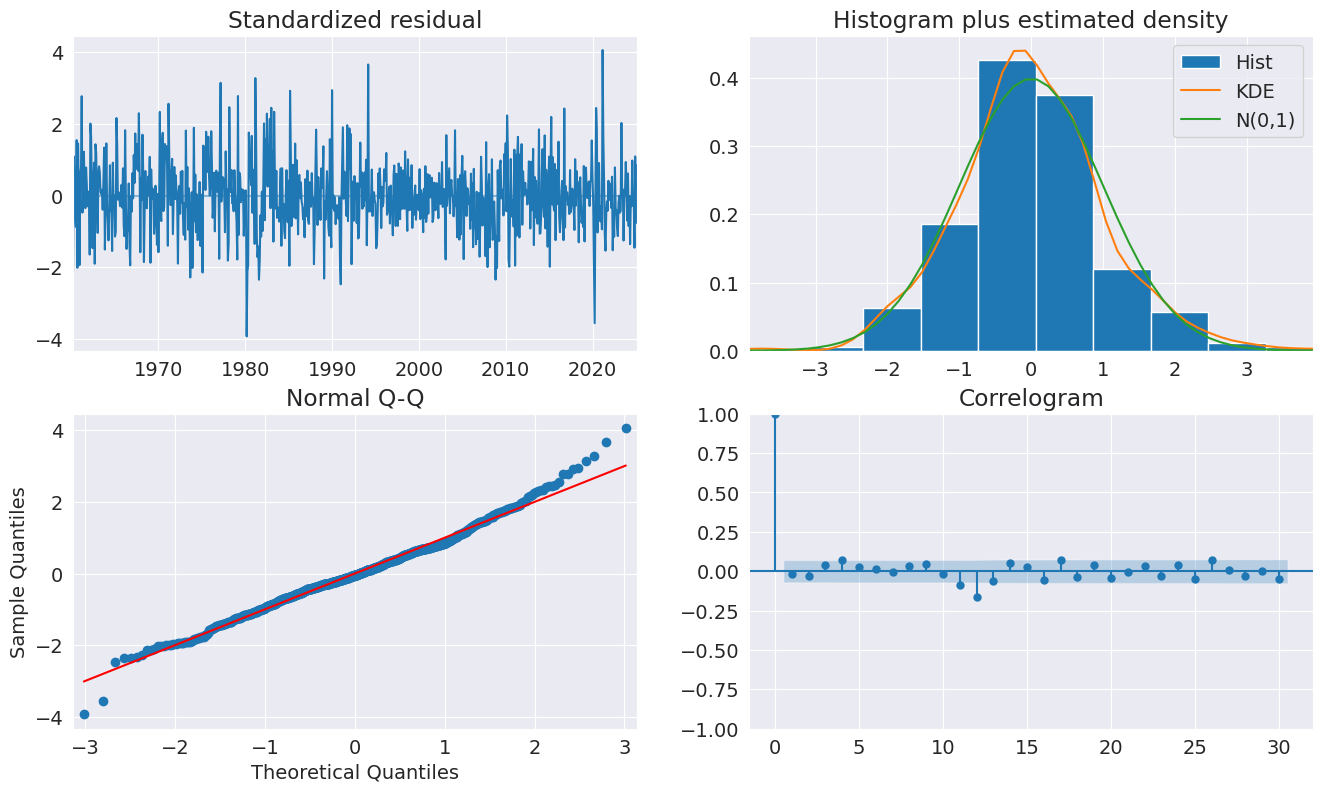

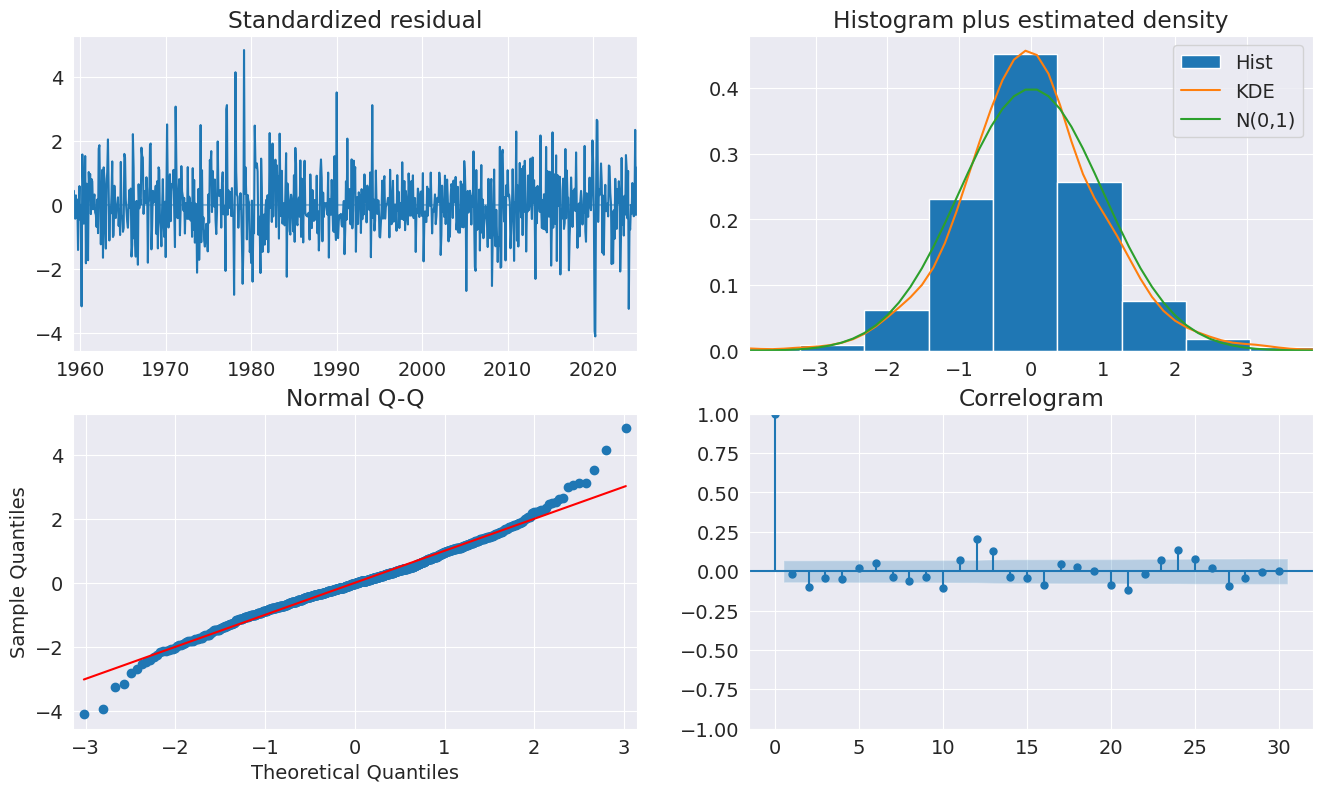

plot_diagnositcs indicates that the model captures the key features in the data.

[8]:

fig = plt.figure(figsize=(16, 9))

fig = res.plot_diagnostics(fig=fig, lags=30)

Seasonal Dummies¶

AutoReg supports seasonal dummies which are an alternative way to model seasonality. Including the dummies shortens the dynamics to only an AR(2).

[9]:

sel = ar_select_order(housing, 13, seasonal=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 793

Model: Seas. AutoReg(1) Log Likelihood -2936.578

Method: Conditional MLE S.D. of innovations 9.864

Date: Tue, 13 Jan 2026 AIC 5901.155

Time: 23:53:25 BIC 5966.599

Sample: 03-01-1959 HQIC 5926.308

- 02-01-2025

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 3.4122 1.223 2.790 0.005 1.015 5.810

s(2,12) 28.8933 1.742 16.589 0.000 25.479 32.307

s(3,12) 16.9396 2.115 8.010 0.000 12.795 21.085

s(4,12) 3.6526 1.821 2.006 0.045 0.084 7.222

s(5,12) -1.9508 1.741 -1.120 0.263 -5.363 1.462

s(6,12) -6.8277 1.725 -3.958 0.000 -10.209 -3.446

s(7,12) -6.0107 1.717 -3.500 0.000 -9.376 -2.645

s(8,12) -7.8424 1.719 -4.562 0.000 -11.212 -4.473

s(9,12) -1.8018 1.717 -1.049 0.294 -5.167 1.564

s(10,12) -17.8929 1.733 -10.324 0.000 -21.290 -14.496

s(11,12) -20.7680 1.757 -11.819 0.000 -24.212 -17.324

s(12,12) -10.8565 1.749 -6.206 0.000 -14.285 -7.428

HOUSTNSA.L1 -0.2273 0.035 -6.560 0.000 -0.295 -0.159

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 -4.4002 +0.0000j 4.4002 0.5000

-----------------------------------------------------------------------------

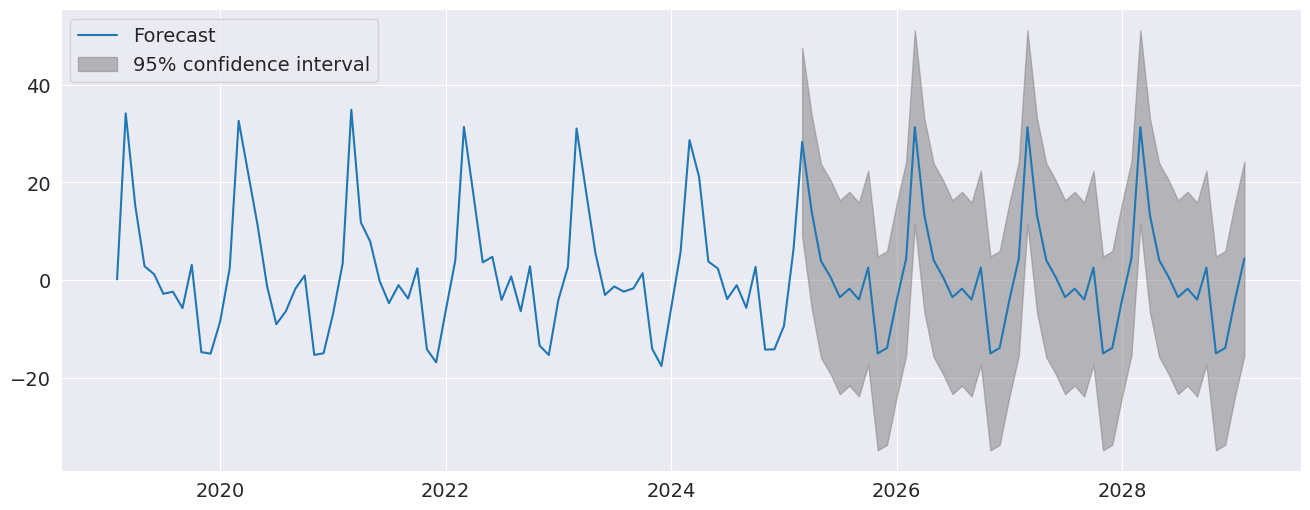

The seasonal dummies are obvious in the forecasts which has a non-trivial seasonal component in all periods 10 years in to the future.

[10]:

fig = res.plot_predict(720, 840)

[11]:

fig = plt.figure(figsize=(16, 9))

fig = res.plot_diagnostics(lags=30, fig=fig)

Seasonal Dynamics¶

While AutoReg does not directly support Seasonal components since it uses OLS to estimate parameters, it is possible to capture seasonal dynamics using an over-parametrized Seasonal AR that does not impose the restrictions in the Seasonal AR.

[12]:

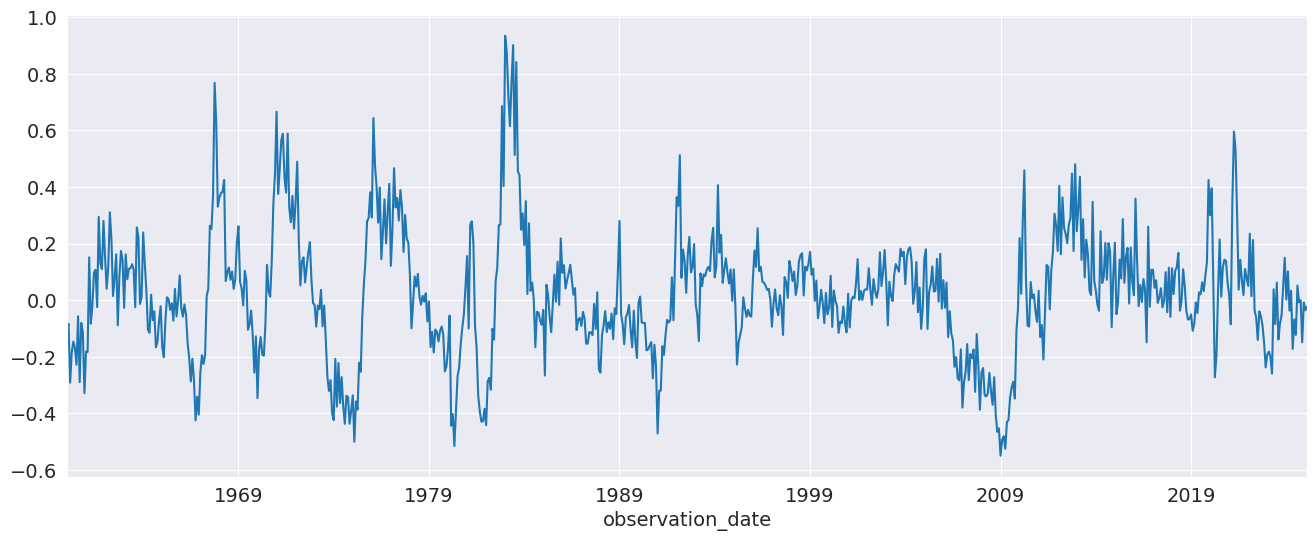

yoy_housing = housing_data.HOUSTNSA.pct_change(12).resample("MS").last().dropna()

_, ax = plt.subplots()

ax = yoy_housing.plot(ax=ax)

We start by selecting a model using the simple method that only chooses the maximum lag. All lower lags are automatically included. The maximum lag to check is set to 13 since this allows the model to next a Seasonal AR that has both a short-run AR(1) component and a Seasonal AR(1) component, so that

which becomes

when expanded. AutoReg does not enforce the structure, but can estimate the nesting model

We see that all 13 lags are selected.

[13]:

sel = ar_select_order(yoy_housing, 13, old_names=False)

sel.ar_lags

[13]:

[1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13]

It seems unlikely that all 13 lags are required. We can set glob=True to search all \(2^{13}\) models that include up to 13 lags.

Here we see that the first three are selected, as is the 7th, and finally the 12th and 13th are selected. This is superficially similar to the structure described above.

After fitting the model, we take a look at the diagnostic plots that indicate that this specification appears to be adequate to capture the dynamics in the data.

[14]:

sel = ar_select_order(yoy_housing, 13, glob=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 782

Model: Restr. AutoReg(13) Log Likelihood 621.088

Method: Conditional MLE S.D. of innovations 0.108

Date: Tue, 13 Jan 2026 AIC -1228.177

Time: 23:53:39 BIC -1195.661

Sample: 02-01-1961 HQIC -1215.663

- 02-01-2025

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 0.0039 0.004 0.984 0.325 -0.004 0.012

HOUSTNSA.L1 0.5995 0.034 17.831 0.000 0.534 0.665

HOUSTNSA.L2 0.2102 0.036 5.766 0.000 0.139 0.282

HOUSTNSA.L3 0.1261 0.034 3.764 0.000 0.060 0.192

HOUSTNSA.L12 -0.4142 0.032 -12.960 0.000 -0.477 -0.352

HOUSTNSA.L13 0.3357 0.032 10.563 0.000 0.273 0.398

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0236 -0.2724j 1.0593 -0.4586

AR.2 -1.0236 +0.2724j 1.0593 0.4586

AR.3 -0.7550 -0.7395j 1.0568 -0.3767

AR.4 -0.7550 +0.7395j 1.0568 0.3767

AR.5 -0.3008 -1.0220j 1.0653 -0.2956

AR.6 -0.3008 +1.0220j 1.0653 0.2956

AR.7 0.2520 -1.0582j 1.0878 -0.2128

AR.8 0.2520 +1.0582j 1.0878 0.2128

AR.9 0.7760 -0.7944j 1.1105 -0.1269

AR.10 0.7760 +0.7944j 1.1105 0.1269

AR.11 1.0958 -0.2296j 1.1196 -0.0329

AR.12 1.0958 +0.2296j 1.1196 0.0329

AR.13 1.1451 -0.0000j 1.1451 -0.0000

------------------------------------------------------------------------------

[15]:

fig = plt.figure(figsize=(16, 9))

fig = res.plot_diagnostics(fig=fig, lags=30)

We can also include seasonal dummies. These are all insignificant since the model is using year-over-year changes.

[16]:

sel = ar_select_order(yoy_housing, 13, glob=True, seasonal=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

====================================================================================

Dep. Variable: HOUSTNSA No. Observations: 782

Model: Restr. Seas. AutoReg(13) Log Likelihood 622.608

Method: Conditional MLE S.D. of innovations 0.108

Date: Wed, 14 Jan 2026 AIC -1209.215

Time: 00:05:57 BIC -1125.604

Sample: 02-01-1961 HQIC -1177.036

- 02-01-2025

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 0.0120 0.013 0.889 0.374 -0.014 0.038

s(2,12) -0.0066 0.019 -0.349 0.727 -0.044 0.031

s(3,12) -0.0101 0.019 -0.531 0.595 -0.047 0.027

s(4,12) -0.0121 0.019 -0.638 0.524 -0.049 0.025

s(5,12) -0.0178 0.019 -0.936 0.349 -0.055 0.020

s(6,12) -0.0179 0.019 -0.940 0.347 -0.055 0.019

s(7,12) -0.0170 0.019 -0.892 0.372 -0.054 0.020

s(8,12) -0.0070 0.019 -0.369 0.712 -0.044 0.030

s(9,12) -0.0068 0.019 -0.357 0.721 -0.044 0.031

s(10,12) -0.0023 0.019 -0.119 0.905 -0.040 0.035

s(11,12) -0.0032 0.019 -0.169 0.866 -0.041 0.034

s(12,12) 0.0035 0.019 0.184 0.854 -0.034 0.041

HOUSTNSA.L1 0.5977 0.034 17.794 0.000 0.532 0.664

HOUSTNSA.L2 0.2104 0.036 5.784 0.000 0.139 0.282

HOUSTNSA.L3 0.1283 0.033 3.832 0.000 0.063 0.194

HOUSTNSA.L12 -0.4159 0.032 -13.032 0.000 -0.478 -0.353

HOUSTNSA.L13 0.3366 0.032 10.607 0.000 0.274 0.399

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0233 -0.2724j 1.0590 -0.4586

AR.2 -1.0233 +0.2724j 1.0590 0.4586

AR.3 -0.7546 -0.7392j 1.0564 -0.3766

AR.4 -0.7546 +0.7392j 1.0564 0.3766

AR.5 -0.3007 -1.0214j 1.0648 -0.2956

AR.6 -0.3007 +1.0214j 1.0648 0.2956

AR.7 0.2517 -1.0580j 1.0875 -0.2128

AR.8 0.2517 +1.0580j 1.0875 0.2128

AR.9 0.7759 -0.7944j 1.1104 -0.1269

AR.10 0.7759 +0.7944j 1.1104 0.1269

AR.11 1.0957 -0.2285j 1.1193 -0.0327

AR.12 1.0957 +0.2285j 1.1193 0.0327

AR.13 1.1463 -0.0000j 1.1463 -0.0000

------------------------------------------------------------------------------

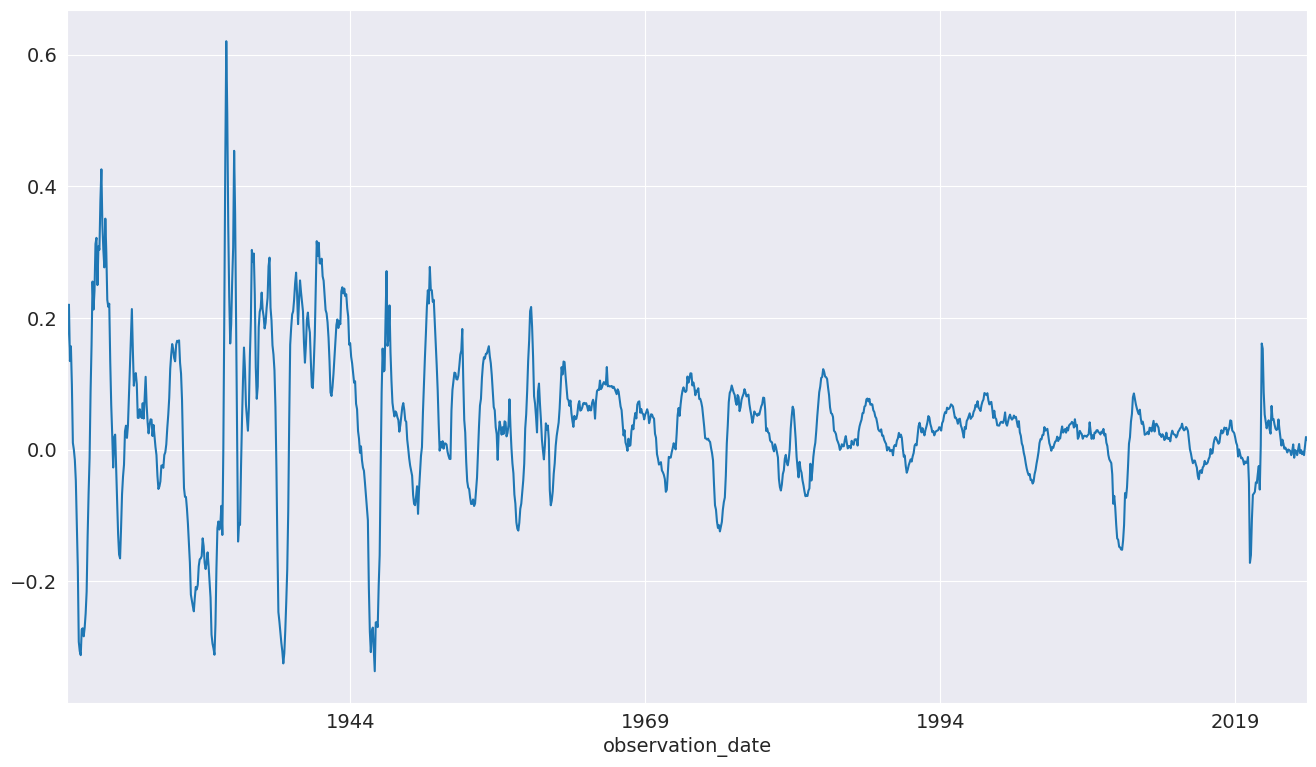

Industrial Production¶

We will use the industrial production index data to examine forecasting.

[17]:

indpro_loc = "https://raw.githubusercontent.com/statsmodels/smdatasets/refs/heads/main/data/autoregressions/INDPRO.csv"

indpro_data = pd.read_csv(

indpro_loc,

index_col=0,

parse_dates=True,

)

ind_prod = indpro_data.INDPRO.pct_change(12).dropna().asfreq("MS")

_, ax = plt.subplots(figsize=(16, 9))

_ = ind_prod.plot(ax=ax)

We will start by selecting a model using up to 12 lags. An AR(13) minimizes the BIC criteria even though many coefficients are insignificant.

[18]:

sel = ar_select_order(ind_prod, 13, "bic", old_names=False)

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: INDPRO No. Observations: 1262

Model: AutoReg(13) Log Likelihood 2994.351

Method: Conditional MLE S.D. of innovations 0.022

Date: Wed, 14 Jan 2026 AIC -5958.703

Time: 00:05:58 BIC -5881.751

Sample: 02-01-1921 HQIC -5929.773

- 02-01-2025

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0022 0.001 3.216 0.001 0.001 0.004

INDPRO.L1 1.3715 0.026 52.595 0.000 1.320 1.423

INDPRO.L2 -0.4501 0.045 -9.965 0.000 -0.539 -0.362

INDPRO.L3 0.0794 0.047 1.692 0.091 -0.013 0.171

INDPRO.L4 -0.0753 0.047 -1.604 0.109 -0.167 0.017

INDPRO.L5 0.0873 0.047 1.856 0.063 -0.005 0.179

INDPRO.L6 -0.1084 0.047 -2.303 0.021 -0.201 -0.016

INDPRO.L7 0.1242 0.047 2.645 0.008 0.032 0.216

INDPRO.L8 -0.0077 0.047 -0.164 0.870 -0.100 0.084

INDPRO.L9 -0.0078 0.047 -0.166 0.868 -0.099 0.084

INDPRO.L10 -0.0166 0.046 -0.359 0.720 -0.107 0.074

INDPRO.L11 -0.0113 0.046 -0.245 0.807 -0.102 0.079

INDPRO.L12 -0.4134 0.044 -9.316 0.000 -0.500 -0.326

INDPRO.L13 0.3692 0.026 14.406 0.000 0.319 0.419

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0764 -0.3227j 1.1237 -0.4536

AR.2 -1.0764 +0.3227j 1.1237 0.4536

AR.3 -0.7663 -0.7879j 1.0991 -0.3728

AR.4 -0.7663 +0.7879j 1.0991 0.3728

AR.5 -0.2371 -1.0693j 1.0953 -0.2847

AR.6 -0.2371 +1.0693j 1.0953 0.2847

AR.7 0.3068 -1.0301j 1.0748 -0.2039

AR.8 0.3068 +1.0301j 1.0748 0.2039

AR.9 0.7629 -0.6971j 1.0335 -0.1178

AR.10 0.7629 +0.6971j 1.0335 0.1178

AR.11 1.0271 -0.2230j 1.0510 -0.0340

AR.12 1.0271 +0.2230j 1.0510 0.0340

AR.13 1.0859 -0.0000j 1.0859 -0.0000

------------------------------------------------------------------------------

We can also use a global search which allows longer lags to enter if needed without requiring the shorter lags. Here we see many lags dropped. The model indicates there may be some seasonality in the data.

[19]:

sel = ar_select_order(ind_prod, 13, "bic", glob=True, old_names=False)

sel.ar_lags

res_glob = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: INDPRO No. Observations: 1262

Model: AutoReg(13) Log Likelihood 2994.351

Method: Conditional MLE S.D. of innovations 0.022

Date: Wed, 14 Jan 2026 AIC -5958.703

Time: 00:06:48 BIC -5881.751

Sample: 02-01-1921 HQIC -5929.773

- 02-01-2025

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0022 0.001 3.216 0.001 0.001 0.004

INDPRO.L1 1.3715 0.026 52.595 0.000 1.320 1.423

INDPRO.L2 -0.4501 0.045 -9.965 0.000 -0.539 -0.362

INDPRO.L3 0.0794 0.047 1.692 0.091 -0.013 0.171

INDPRO.L4 -0.0753 0.047 -1.604 0.109 -0.167 0.017

INDPRO.L5 0.0873 0.047 1.856 0.063 -0.005 0.179

INDPRO.L6 -0.1084 0.047 -2.303 0.021 -0.201 -0.016

INDPRO.L7 0.1242 0.047 2.645 0.008 0.032 0.216

INDPRO.L8 -0.0077 0.047 -0.164 0.870 -0.100 0.084

INDPRO.L9 -0.0078 0.047 -0.166 0.868 -0.099 0.084

INDPRO.L10 -0.0166 0.046 -0.359 0.720 -0.107 0.074

INDPRO.L11 -0.0113 0.046 -0.245 0.807 -0.102 0.079

INDPRO.L12 -0.4134 0.044 -9.316 0.000 -0.500 -0.326

INDPRO.L13 0.3692 0.026 14.406 0.000 0.319 0.419

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0764 -0.3227j 1.1237 -0.4536

AR.2 -1.0764 +0.3227j 1.1237 0.4536

AR.3 -0.7663 -0.7879j 1.0991 -0.3728

AR.4 -0.7663 +0.7879j 1.0991 0.3728

AR.5 -0.2371 -1.0693j 1.0953 -0.2847

AR.6 -0.2371 +1.0693j 1.0953 0.2847

AR.7 0.3068 -1.0301j 1.0748 -0.2039

AR.8 0.3068 +1.0301j 1.0748 0.2039

AR.9 0.7629 -0.6971j 1.0335 -0.1178

AR.10 0.7629 +0.6971j 1.0335 0.1178

AR.11 1.0271 -0.2230j 1.0510 -0.0340

AR.12 1.0271 +0.2230j 1.0510 0.0340

AR.13 1.0859 -0.0000j 1.0859 -0.0000

------------------------------------------------------------------------------

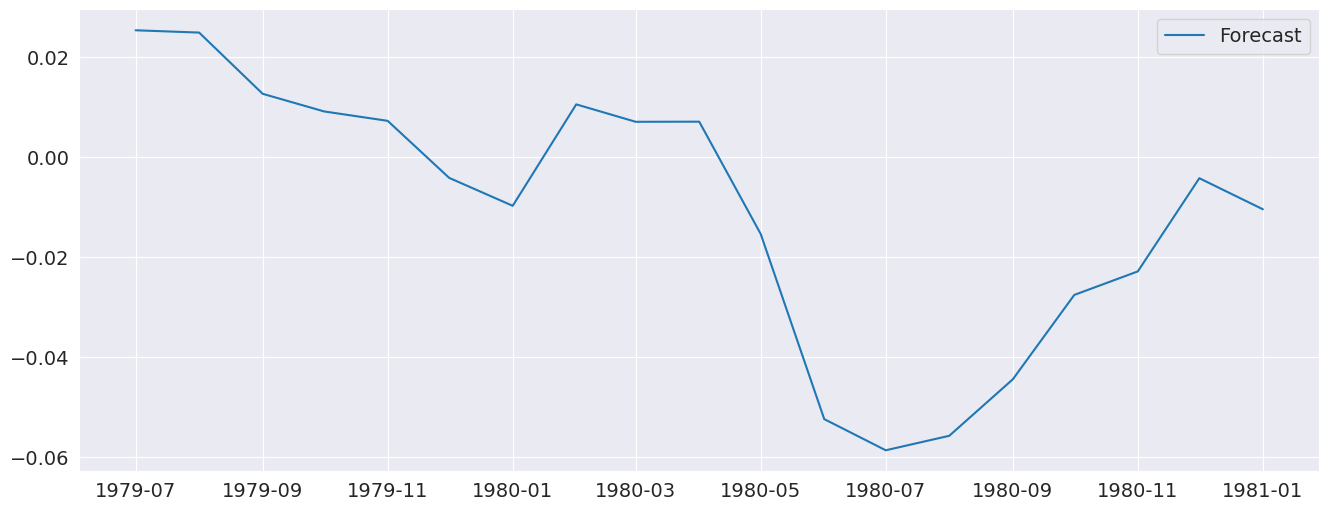

plot_predict can be used to produce forecast plots along with confidence intervals. Here we produce forecasts starting at the last observation and continuing for 18 months.

[20]:

ind_prod.shape

[20]:

(1262,)

[21]:

fig = res_glob.plot_predict(start=714, end=732)

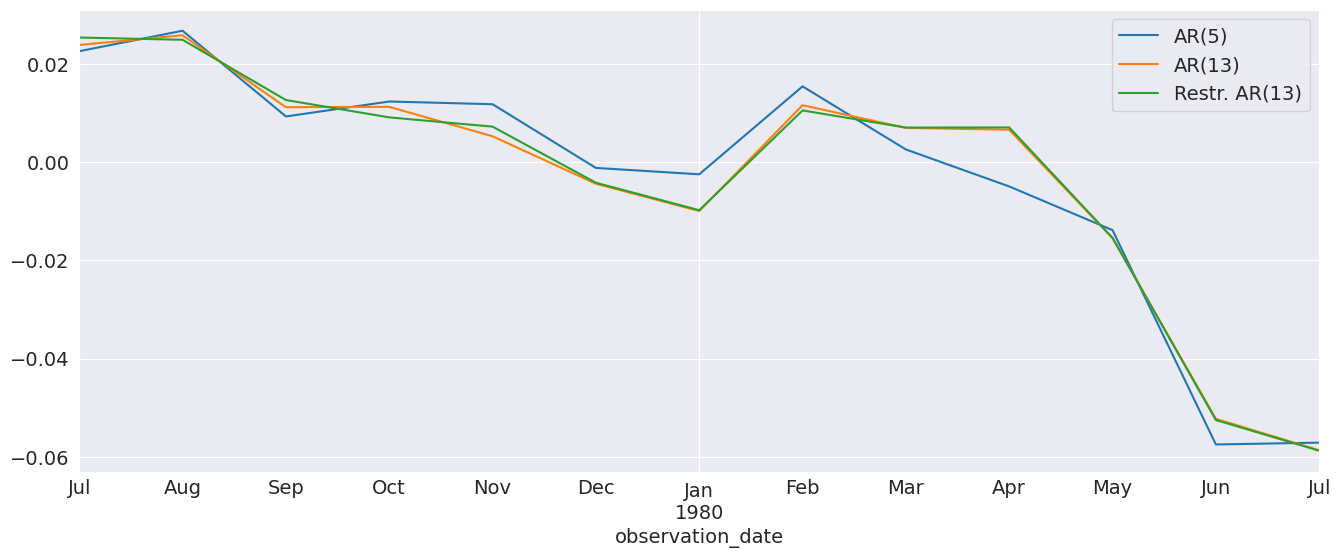

The forecasts from the full model and the restricted model are very similar. I also include an AR(5) which has very different dynamics

[22]:

res_ar5 = AutoReg(ind_prod, 5, old_names=False).fit()

predictions = pd.DataFrame(

{

"AR(5)": res_ar5.predict(start=714, end=726),

"AR(13)": res.predict(start=714, end=726),

"Restr. AR(13)": res_glob.predict(start=714, end=726),

}

)

_, ax = plt.subplots()

ax = predictions.plot(ax=ax)

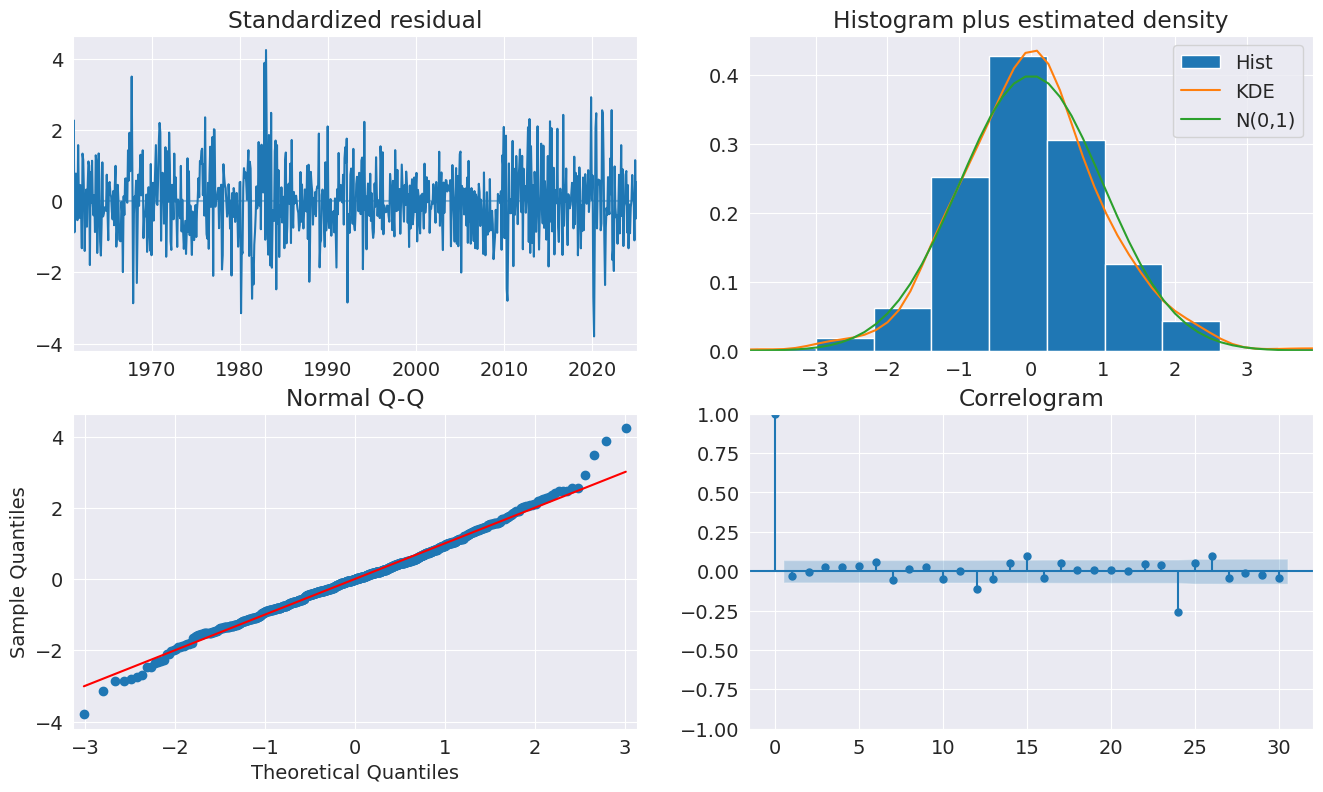

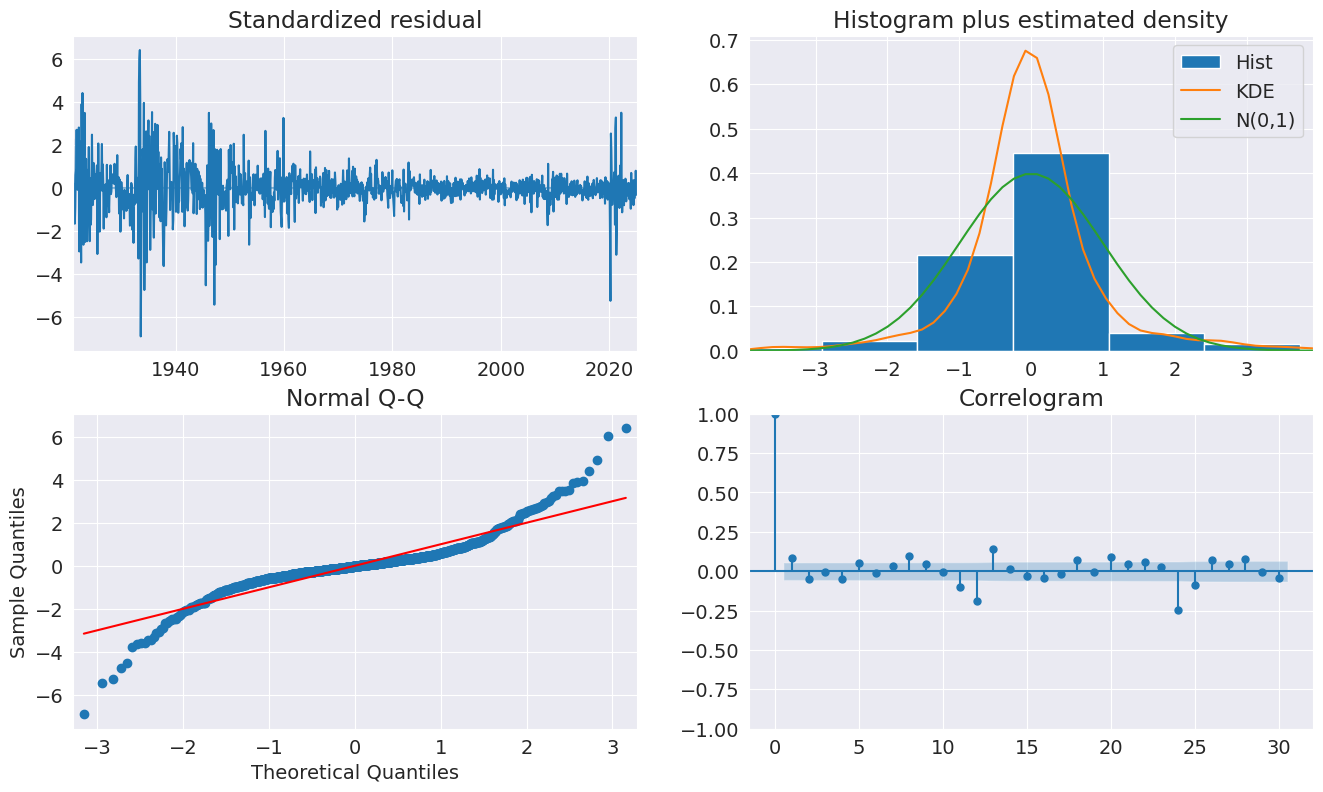

The diagnostics indicate the model captures most of the the dynamics in the data. The ACF shows a pattern at the seasonal frequency and so a more complete seasonal model (SARIMAX) may be needed.

[23]:

fig = plt.figure(figsize=(16, 9))

fig = res_glob.plot_diagnostics(fig=fig, lags=30)

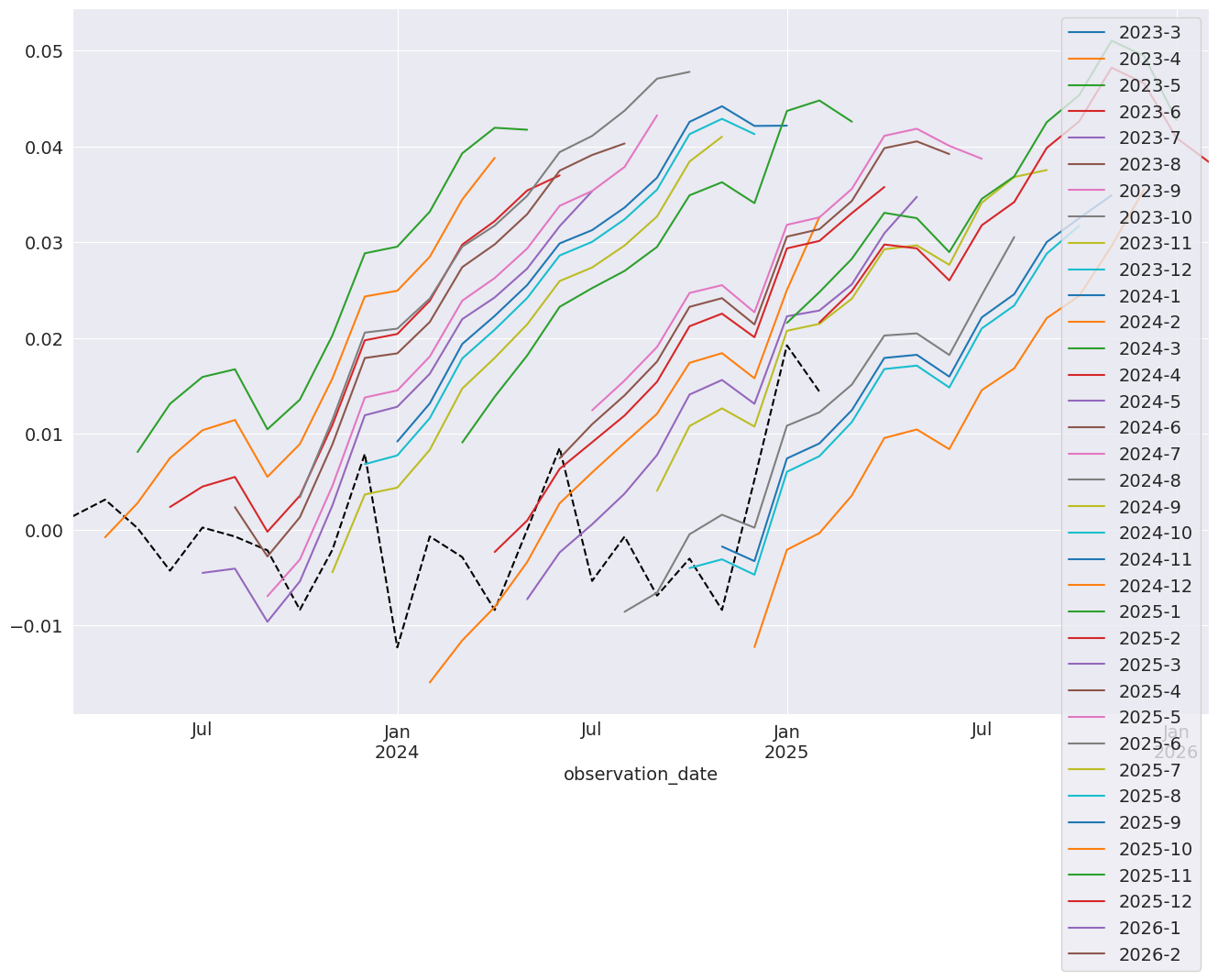

Forecasting¶

Forecasts are produced using the predict method from a results instance. The default produces static forecasts which are one-step forecasts. Producing multi-step forecasts requires using dynamic=True.

In this next cell, we produce 12-step-heard forecasts for the final 24 periods in the sample. This requires a loop.

Note: These are technically in-sample since the data we are forecasting was used to estimate parameters. Producing OOS forecasts requires two models. The first must exclude the OOS period. The second uses the predict method from the full-sample model with the parameters from the shorter sample model that excluded the OOS period.

[24]:

import numpy as np

start = ind_prod.index[-24]

forecast_index = pd.date_range(start, freq=ind_prod.index.freq, periods=36)

cols = ["-".join(str(val) for val in (idx.year, idx.month)) for idx in forecast_index]

forecasts = pd.DataFrame(index=forecast_index, columns=cols)

for i in range(1, 24):

fcast = res_glob.predict(

start=forecast_index[i], end=forecast_index[i + 12], dynamic=True

)

forecasts.loc[fcast.index, cols[i]] = fcast

_, ax = plt.subplots(figsize=(16, 10))

ind_prod.iloc[-24:].plot(ax=ax, color="black", linestyle="--")

ax = forecasts.plot(ax=ax)

Comparing to SARIMAX¶

SARIMAX is an implementation of a Seasonal Autoregressive Integrated Moving Average with eXogenous regressors model. It supports:

Specification of seasonal and nonseasonal AR and MA components

Inclusion of Exogenous variables

Full maximum-likelihood estimation using the Kalman Filter

This model is more feature rich than AutoReg. Unlike SARIMAX, AutoReg estimates parameters using OLS. This is faster and the problem is globally convex, and so there are no issues with local minima. The closed-form estimator and its performance are the key advantages of AutoReg over SARIMAX when comparing AR(P) models. AutoReg also support seasonal dummies, which can be used with SARIMAX if the user includes them as exogenous regressors.

[25]:

from statsmodels.tsa.api import SARIMAX

sarimax_mod = SARIMAX(ind_prod, order=((1, 2, 7, 12, 13), 0, 0), trend="c")

sarimax_res = sarimax_mod.fit()

print(sarimax_res.summary())

SARIMAX Results

============================================================================================

Dep. Variable: INDPRO No. Observations: 1262

Model: SARIMAX([1, 2, 7, 12, 13], 0, 0) Log Likelihood 2994.915

Date: Wed, 14 Jan 2026 AIC -5975.830

Time: 00:06:59 BIC -5939.847

Sample: 01-01-1920 HQIC -5962.309

- 02-01-2025

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0020 0.001 2.789 0.005 0.001 0.003

ar.L1 1.3548 0.010 137.051 0.000 1.335 1.374

ar.L2 -0.3914 0.011 -34.693 0.000 -0.414 -0.369

ar.L7 0.0435 0.006 7.876 0.000 0.033 0.054

ar.L12 -0.4615 0.014 -33.795 0.000 -0.488 -0.435

ar.L13 0.3970 0.013 30.229 0.000 0.371 0.423

sigma2 0.0005 9.64e-06 52.480 0.000 0.000 0.001

===================================================================================

Ljung-Box (L1) (Q): 7.87 Jarque-Bera (JB): 3275.97

Prob(Q): 0.01 Prob(JB): 0.00

Heteroskedasticity (H): 0.14 Skew: 0.04

Prob(H) (two-sided): 0.00 Kurtosis: 10.89

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

[26]:

sarimax_params = sarimax_res.params.iloc[:-1].copy()

sarimax_params.index = res_glob.params.index

params = pd.concat([res_glob.params, sarimax_params], axis=1, sort=False)

params.columns = ["AutoReg", "SARIMAX"]

params

[26]:

| AutoReg | SARIMAX | |

|---|---|---|

| const | 0.002252 | 0.001954 |

| INDPRO.L1 | 1.355149 | 1.354845 |

| INDPRO.L2 | -0.396530 | -0.391420 |

| INDPRO.L7 | 0.048080 | 0.043527 |

| INDPRO.L12 | -0.447984 | -0.461550 |

| INDPRO.L13 | 0.381658 | 0.396978 |

Custom Deterministic Processes¶

The deterministic parameter allows a custom DeterministicProcess to be used. This allows for more complex deterministic terms to be constructed, for example one that includes seasonal components with two periods, or, as the next example shows, one that uses a Fourier series rather than seasonal dummies.

[27]:

from statsmodels.tsa.deterministic import DeterministicProcess

dp = DeterministicProcess(housing.index, constant=True, period=12, fourier=2)

mod = AutoReg(housing, 2, trend="n", seasonal=False, deterministic=dp)

res = mod.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 793

Model: AutoReg(2) Log Likelihood -2992.123

Method: Conditional MLE S.D. of innovations 10.631

Date: Wed, 14 Jan 2026 AIC 6000.246

Time: 00:06:59 BIC 6037.633

Sample: 04-01-1959 HQIC 6014.616

- 02-01-2025

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.6409 0.383 4.282 0.000 0.890 2.392

sin(1,12) 15.0006 0.804 18.648 0.000 13.424 16.577

cos(1,12) 4.9139 0.571 8.613 0.000 3.796 6.032

sin(2,12) 11.6808 0.597 19.573 0.000 10.511 12.850

cos(2,12) 0.2304 0.706 0.326 0.744 -1.153 1.614

HOUSTNSA.L1 -0.3350 0.035 -9.517 0.000 -0.404 -0.266

HOUSTNSA.L2 -0.1397 0.035 -3.969 0.000 -0.209 -0.071

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 -1.1989 -2.3915j 2.6752 -0.3240

AR.2 -1.1989 +2.3915j 2.6752 0.3240

-----------------------------------------------------------------------------

[28]:

fig = res.plot_predict(720, 840)