Deterministic Terms in Time Series Models¶

[1]:

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

plt.rc("figure", figsize=(16, 9))

plt.rc("font", size=16)

Basic Use¶

Basic configurations can be directly constructed through DeterministicProcess. These can include a constant, a time trend of any order, and either a seasonal or a Fourier component.

The process requires an index, which is the index of the full-sample (or in-sample).

First, we initialize a deterministic process with a constant, a linear time trend, and a 5-period seasonal term. The in_sample method returns the full set of values that match the index.

[2]:

from statsmodels.tsa.deterministic import DeterministicProcess

index = pd.RangeIndex(0, 100)

det_proc = DeterministicProcess(index, constant=True, order=1, seasonal=True, period=5)

det_proc.in_sample()

[2]:

| const | trend | s(2,5) | s(3,5) | s(4,5) | s(5,5) | |

|---|---|---|---|---|---|---|

| 0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 1 | 1.0 | 2.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 2 | 1.0 | 3.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 3 | 1.0 | 4.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 4 | 1.0 | 5.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| ... | ... | ... | ... | ... | ... | ... |

| 95 | 1.0 | 96.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 96 | 1.0 | 97.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 97 | 1.0 | 98.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 98 | 1.0 | 99.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 99 | 1.0 | 100.0 | 0.0 | 0.0 | 0.0 | 1.0 |

100 rows × 6 columns

The out_of_sample returns the next steps values after the end of the in-sample.

[3]:

det_proc.out_of_sample(15)

[3]:

| const | trend | s(2,5) | s(3,5) | s(4,5) | s(5,5) | |

|---|---|---|---|---|---|---|

| 100 | 1.0 | 101.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 101 | 1.0 | 102.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 102 | 1.0 | 103.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 103 | 1.0 | 104.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 104 | 1.0 | 105.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 105 | 1.0 | 106.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 106 | 1.0 | 107.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 107 | 1.0 | 108.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 108 | 1.0 | 109.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 109 | 1.0 | 110.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 110 | 1.0 | 111.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 111 | 1.0 | 112.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 112 | 1.0 | 113.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 113 | 1.0 | 114.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 114 | 1.0 | 115.0 | 0.0 | 0.0 | 0.0 | 1.0 |

range(start, stop) can also be used to produce the deterministic terms over any range including in- and out-of-sample.

Notes¶

When the index is a pandas

DatetimeIndexor aPeriodIndex, thenstartandstopcan be date-like (strings, e.g., “2020-06-01”, or Timestamp) or integers.stopis always included in the range. While this is not very Pythonic, it is needed since both statsmodels and Pandas includestopwhen working with date-like slices.

[4]:

det_proc.range(190, 210)

[4]:

| const | trend | s(2,5) | s(3,5) | s(4,5) | s(5,5) | |

|---|---|---|---|---|---|---|

| 190 | 1.0 | 191.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 191 | 1.0 | 192.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 192 | 1.0 | 193.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 193 | 1.0 | 194.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 194 | 1.0 | 195.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 195 | 1.0 | 196.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 196 | 1.0 | 197.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 197 | 1.0 | 198.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 198 | 1.0 | 199.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 199 | 1.0 | 200.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 200 | 1.0 | 201.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 201 | 1.0 | 202.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 202 | 1.0 | 203.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 203 | 1.0 | 204.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 204 | 1.0 | 205.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 205 | 1.0 | 206.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 206 | 1.0 | 207.0 | 1.0 | 0.0 | 0.0 | 0.0 |

| 207 | 1.0 | 208.0 | 0.0 | 1.0 | 0.0 | 0.0 |

| 208 | 1.0 | 209.0 | 0.0 | 0.0 | 1.0 | 0.0 |

| 209 | 1.0 | 210.0 | 0.0 | 0.0 | 0.0 | 1.0 |

| 210 | 1.0 | 211.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Using a Date-like Index¶

Next, we show the same steps using a PeriodIndex.

[5]:

index = pd.period_range("2020-03-01", freq="M", periods=60)

det_proc = DeterministicProcess(index, constant=True, fourier=2)

det_proc.in_sample().head(12)

[5]:

| const | sin(1,12) | cos(1,12) | sin(2,12) | cos(2,12) | |

|---|---|---|---|---|---|

| 2020-03 | 1.0 | 0.000000e+00 | 1.000000e+00 | 0.000000e+00 | 1.0 |

| 2020-04 | 1.0 | 5.000000e-01 | 8.660254e-01 | 8.660254e-01 | 0.5 |

| 2020-05 | 1.0 | 8.660254e-01 | 5.000000e-01 | 8.660254e-01 | -0.5 |

| 2020-06 | 1.0 | 1.000000e+00 | 6.123234e-17 | 1.224647e-16 | -1.0 |

| 2020-07 | 1.0 | 8.660254e-01 | -5.000000e-01 | -8.660254e-01 | -0.5 |

| 2020-08 | 1.0 | 5.000000e-01 | -8.660254e-01 | -8.660254e-01 | 0.5 |

| 2020-09 | 1.0 | 1.224647e-16 | -1.000000e+00 | -2.449294e-16 | 1.0 |

| 2020-10 | 1.0 | -5.000000e-01 | -8.660254e-01 | 8.660254e-01 | 0.5 |

| 2020-11 | 1.0 | -8.660254e-01 | -5.000000e-01 | 8.660254e-01 | -0.5 |

| 2020-12 | 1.0 | -1.000000e+00 | -1.836970e-16 | 3.673940e-16 | -1.0 |

| 2021-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

| 2021-02 | 1.0 | -5.000000e-01 | 8.660254e-01 | -8.660254e-01 | 0.5 |

[6]:

det_proc.out_of_sample(12)

[6]:

| const | sin(1,12) | cos(1,12) | sin(2,12) | cos(2,12) | |

|---|---|---|---|---|---|

| 2025-03 | 1.0 | -1.224647e-15 | 1.000000e+00 | -2.449294e-15 | 1.0 |

| 2025-04 | 1.0 | 5.000000e-01 | 8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-05 | 1.0 | 8.660254e-01 | 5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-06 | 1.0 | 1.000000e+00 | -4.904777e-16 | -9.809554e-16 | -1.0 |

| 2025-07 | 1.0 | 8.660254e-01 | -5.000000e-01 | -8.660254e-01 | -0.5 |

| 2025-08 | 1.0 | 5.000000e-01 | -8.660254e-01 | -8.660254e-01 | 0.5 |

| 2025-09 | 1.0 | 4.899825e-15 | -1.000000e+00 | -9.799650e-15 | 1.0 |

| 2025-10 | 1.0 | -5.000000e-01 | -8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-11 | 1.0 | -8.660254e-01 | -5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-12 | 1.0 | -1.000000e+00 | -3.184701e-15 | 6.369401e-15 | -1.0 |

| 2026-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

| 2026-02 | 1.0 | -5.000000e-01 | 8.660254e-01 | -8.660254e-01 | 0.5 |

range accepts date-like arguments, which are usually given as strings.

[7]:

det_proc.range("2025-01", "2026-01")

[7]:

| const | sin(1,12) | cos(1,12) | sin(2,12) | cos(2,12) | |

|---|---|---|---|---|---|

| 2025-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

| 2025-02 | 1.0 | -5.000000e-01 | 8.660254e-01 | -8.660254e-01 | 0.5 |

| 2025-03 | 1.0 | -1.224647e-15 | 1.000000e+00 | -2.449294e-15 | 1.0 |

| 2025-04 | 1.0 | 5.000000e-01 | 8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-05 | 1.0 | 8.660254e-01 | 5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-06 | 1.0 | 1.000000e+00 | -4.904777e-16 | -9.809554e-16 | -1.0 |

| 2025-07 | 1.0 | 8.660254e-01 | -5.000000e-01 | -8.660254e-01 | -0.5 |

| 2025-08 | 1.0 | 5.000000e-01 | -8.660254e-01 | -8.660254e-01 | 0.5 |

| 2025-09 | 1.0 | 4.899825e-15 | -1.000000e+00 | -9.799650e-15 | 1.0 |

| 2025-10 | 1.0 | -5.000000e-01 | -8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-11 | 1.0 | -8.660254e-01 | -5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-12 | 1.0 | -1.000000e+00 | -3.184701e-15 | 6.369401e-15 | -1.0 |

| 2026-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

This is equivalent to using the integer values 58 and 70.

[8]:

det_proc.range(58, 70)

[8]:

| const | sin(1,12) | cos(1,12) | sin(2,12) | cos(2,12) | |

|---|---|---|---|---|---|

| 2025-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

| 2025-02 | 1.0 | -5.000000e-01 | 8.660254e-01 | -8.660254e-01 | 0.5 |

| 2025-03 | 1.0 | -1.224647e-15 | 1.000000e+00 | -2.449294e-15 | 1.0 |

| 2025-04 | 1.0 | 5.000000e-01 | 8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-05 | 1.0 | 8.660254e-01 | 5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-06 | 1.0 | 1.000000e+00 | -4.904777e-16 | -9.809554e-16 | -1.0 |

| 2025-07 | 1.0 | 8.660254e-01 | -5.000000e-01 | -8.660254e-01 | -0.5 |

| 2025-08 | 1.0 | 5.000000e-01 | -8.660254e-01 | -8.660254e-01 | 0.5 |

| 2025-09 | 1.0 | 4.899825e-15 | -1.000000e+00 | -9.799650e-15 | 1.0 |

| 2025-10 | 1.0 | -5.000000e-01 | -8.660254e-01 | 8.660254e-01 | 0.5 |

| 2025-11 | 1.0 | -8.660254e-01 | -5.000000e-01 | 8.660254e-01 | -0.5 |

| 2025-12 | 1.0 | -1.000000e+00 | -3.184701e-15 | 6.369401e-15 | -1.0 |

| 2026-01 | 1.0 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | -0.5 |

Advanced Construction¶

Deterministic processes with features not supported directly through the constructor can be created using additional_terms which accepts a list of DetermisticTerm. Here we create a deterministic process with two seasonal components: day-of-week with a 5 day period and an annual captured through a Fourier component with a period of 365.25 days.

[9]:

from statsmodels.tsa.deterministic import Fourier, Seasonality, TimeTrend

index = pd.period_range("2020-03-01", freq="D", periods=2 * 365)

tt = TimeTrend(constant=True)

four = Fourier(period=365.25, order=2)

seas = Seasonality(period=7)

det_proc = DeterministicProcess(index, additional_terms=[tt, seas, four])

det_proc.in_sample().head(28)

[9]:

| const | s(2,7) | s(3,7) | s(4,7) | s(5,7) | s(6,7) | s(7,7) | sin(1,365.25) | cos(1,365.25) | sin(2,365.25) | cos(2,365.25) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-03-01 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 1.000000 | 0.000000 | 1.000000 |

| 2020-03-02 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.017202 | 0.999852 | 0.034398 | 0.999408 |

| 2020-03-03 | 1.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.034398 | 0.999408 | 0.068755 | 0.997634 |

| 2020-03-04 | 1.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.051584 | 0.998669 | 0.103031 | 0.994678 |

| 2020-03-05 | 1.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.068755 | 0.997634 | 0.137185 | 0.990545 |

| 2020-03-06 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.085906 | 0.996303 | 0.171177 | 0.985240 |

| 2020-03-07 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.103031 | 0.994678 | 0.204966 | 0.978769 |

| 2020-03-08 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.120126 | 0.992759 | 0.238513 | 0.971139 |

| 2020-03-09 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.137185 | 0.990545 | 0.271777 | 0.962360 |

| 2020-03-10 | 1.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.154204 | 0.988039 | 0.304719 | 0.952442 |

| 2020-03-11 | 1.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.171177 | 0.985240 | 0.337301 | 0.941397 |

| 2020-03-12 | 1.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.188099 | 0.982150 | 0.369484 | 0.929237 |

| 2020-03-13 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.204966 | 0.978769 | 0.401229 | 0.915978 |

| 2020-03-14 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.221772 | 0.975099 | 0.432499 | 0.901634 |

| 2020-03-15 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.238513 | 0.971139 | 0.463258 | 0.886224 |

| 2020-03-16 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.255182 | 0.966893 | 0.493468 | 0.869764 |

| 2020-03-17 | 1.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.271777 | 0.962360 | 0.523094 | 0.852275 |

| 2020-03-18 | 1.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.288291 | 0.957543 | 0.552101 | 0.833777 |

| 2020-03-19 | 1.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.304719 | 0.952442 | 0.580455 | 0.814292 |

| 2020-03-20 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.321058 | 0.947060 | 0.608121 | 0.793844 |

| 2020-03-21 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.337301 | 0.941397 | 0.635068 | 0.772456 |

| 2020-03-22 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.353445 | 0.935455 | 0.661263 | 0.750154 |

| 2020-03-23 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.369484 | 0.929237 | 0.686676 | 0.726964 |

| 2020-03-24 | 1.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.385413 | 0.922744 | 0.711276 | 0.702913 |

| 2020-03-25 | 1.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.401229 | 0.915978 | 0.735034 | 0.678031 |

| 2020-03-26 | 1.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.0 | 0.416926 | 0.908940 | 0.757922 | 0.652346 |

| 2020-03-27 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0 | 0.432499 | 0.901634 | 0.779913 | 0.625889 |

| 2020-03-28 | 1.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.447945 | 0.894061 | 0.800980 | 0.598691 |

Custom Deterministic Terms¶

The DetermisticTerm Abstract Base Class is designed to be subclassed to help users write custom deterministic terms. We next show two examples. The first is a broken time trend that allows a break after a fixed number of periods. The second is a “trick” deterministic term that allows exogenous data, which is not really a deterministic process, to be treated as if was deterministic. This lets use simplify gathering the terms needed for forecasting.

These are intended to demonstrate the construction of custom terms. They can definitely be improved in terms of input validation.

[10]:

from statsmodels.tsa.deterministic import DeterministicTerm

class BrokenTimeTrend(DeterministicTerm):

def __init__(self, break_period: int):

self._break_period = break_period

def __str__(self):

return "Broken Time Trend"

def _eq_attr(self):

return (self._break_period,)

def in_sample(self, index: pd.Index):

nobs = index.shape[0]

terms = np.zeros((nobs, 2))

terms[self._break_period :, 0] = 1

terms[self._break_period :, 1] = np.arange(self._break_period + 1, nobs + 1)

return pd.DataFrame(terms, columns=["const_break", "trend_break"], index=index)

def out_of_sample(

self, steps: int, index: pd.Index, forecast_index: pd.Index = None

):

# Always call extend index first

fcast_index = self._extend_index(index, steps, forecast_index)

nobs = index.shape[0]

terms = np.zeros((steps, 2))

# Assume break period is in-sample

terms[:, 0] = 1

terms[:, 1] = np.arange(nobs + 1, nobs + steps + 1)

return pd.DataFrame(

terms, columns=["const_break", "trend_break"], index=fcast_index

)

[11]:

btt = BrokenTimeTrend(60)

tt = TimeTrend(constant=True, order=1)

index = pd.RangeIndex(100)

det_proc = DeterministicProcess(index, additional_terms=[tt, btt])

det_proc.range(55, 65)

[11]:

| const | trend | const_break | trend_break | |

|---|---|---|---|---|

| 55 | 1.0 | 56.0 | 0.0 | 0.0 |

| 56 | 1.0 | 57.0 | 0.0 | 0.0 |

| 57 | 1.0 | 58.0 | 0.0 | 0.0 |

| 58 | 1.0 | 59.0 | 0.0 | 0.0 |

| 59 | 1.0 | 60.0 | 0.0 | 0.0 |

| 60 | 1.0 | 61.0 | 1.0 | 61.0 |

| 61 | 1.0 | 62.0 | 1.0 | 62.0 |

| 62 | 1.0 | 63.0 | 1.0 | 63.0 |

| 63 | 1.0 | 64.0 | 1.0 | 64.0 |

| 64 | 1.0 | 65.0 | 1.0 | 65.0 |

| 65 | 1.0 | 66.0 | 1.0 | 66.0 |

Next, we write a simple “wrapper” for some actual exogenous data that simplifies constructing out-of-sample exogenous arrays for forecasting.

[12]:

class ExogenousProcess(DeterministicTerm):

def __init__(self, data):

self._data = data

def __str__(self):

return "Custom Exog Process"

def _eq_attr(self):

return (id(self._data),)

def in_sample(self, index: pd.Index):

return self._data.loc[index]

def out_of_sample(

self, steps: int, index: pd.Index, forecast_index: pd.Index = None

):

forecast_index = self._extend_index(index, steps, forecast_index)

return self._data.loc[forecast_index]

[13]:

import numpy as np

gen = np.random.default_rng(98765432101234567890)

exog = pd.DataFrame(gen.integers(100, size=(300, 2)), columns=["exog1", "exog2"])

exog.head()

[13]:

| exog1 | exog2 | |

|---|---|---|

| 0 | 6 | 99 |

| 1 | 64 | 28 |

| 2 | 15 | 81 |

| 3 | 54 | 8 |

| 4 | 12 | 8 |

[14]:

ep = ExogenousProcess(exog)

tt = TimeTrend(constant=True, order=1)

# The in-sample index

idx = exog.index[:200]

det_proc = DeterministicProcess(idx, additional_terms=[tt, ep])

[15]:

det_proc.in_sample().head()

[15]:

| const | trend | exog1 | exog2 | |

|---|---|---|---|---|

| 0 | 1.0 | 1.0 | 6 | 99 |

| 1 | 1.0 | 2.0 | 64 | 28 |

| 2 | 1.0 | 3.0 | 15 | 81 |

| 3 | 1.0 | 4.0 | 54 | 8 |

| 4 | 1.0 | 5.0 | 12 | 8 |

[16]:

det_proc.out_of_sample(10)

[16]:

| const | trend | exog1 | exog2 | |

|---|---|---|---|---|

| 200 | 1.0 | 201.0 | 56 | 88 |

| 201 | 1.0 | 202.0 | 48 | 84 |

| 202 | 1.0 | 203.0 | 44 | 5 |

| 203 | 1.0 | 204.0 | 65 | 63 |

| 204 | 1.0 | 205.0 | 63 | 39 |

| 205 | 1.0 | 206.0 | 89 | 39 |

| 206 | 1.0 | 207.0 | 41 | 54 |

| 207 | 1.0 | 208.0 | 71 | 5 |

| 208 | 1.0 | 209.0 | 89 | 6 |

| 209 | 1.0 | 210.0 | 58 | 63 |

Model Support¶

The only model that directly supports DeterministicProcess is AutoReg. A custom term can be set using the deterministic keyword argument.

Note: Using a custom term requires that trend="n" and seasonal=False so that all deterministic components must come from the custom deterministic term.

Simulate Some Data¶

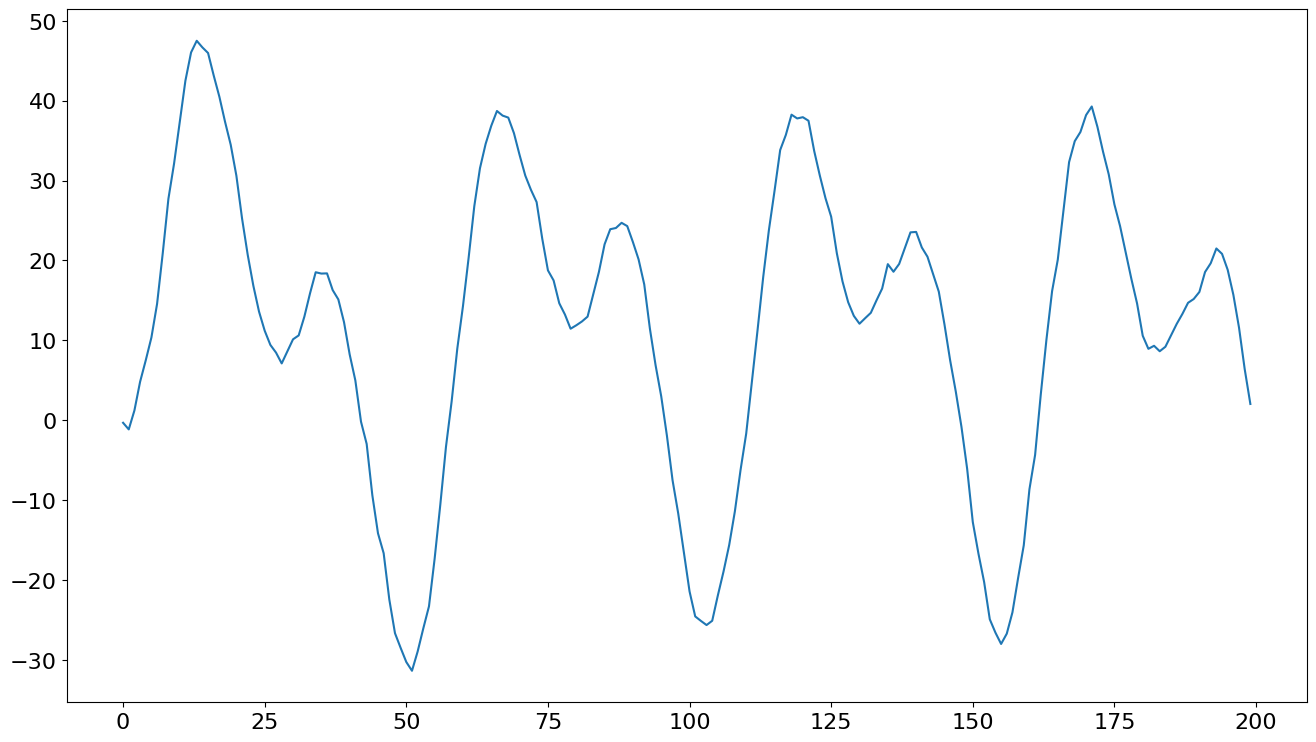

Here we simulate some data that has an weekly seasonality captured by a Fourier series.

[17]:

gen = np.random.default_rng(98765432101234567890)

idx = pd.RangeIndex(200)

det_proc = DeterministicProcess(idx, constant=True, period=52, fourier=2)

det_terms = det_proc.in_sample().to_numpy()

params = np.array([1.0, 3, -1, 4, -2])

exog = det_terms @ params

y = np.empty(200)

y[0] = det_terms[0] @ params + gen.standard_normal()

for i in range(1, 200):

y[i] = 0.9 * y[i - 1] + det_terms[i] @ params + gen.standard_normal()

y = pd.Series(y, index=idx)

ax = y.plot()

The model is then fit using the deterministic keyword argument. seasonal defaults to False but trend defaults to "c" so this needs to be changed.

[18]:

from statsmodels.tsa.api import AutoReg

mod = AutoReg(y, 1, trend="n", deterministic=det_proc)

res = mod.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: y No. Observations: 200

Model: AutoReg(1) Log Likelihood -270.964

Method: Conditional MLE S.D. of innovations 0.944

Date: Tue, 13 Jan 2026 AIC 555.927

Time: 23:59:10 BIC 578.980

Sample: 1 HQIC 565.258

200

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.8436 0.172 4.916 0.000 0.507 1.180

sin(1,52) 2.9738 0.160 18.587 0.000 2.660 3.287

cos(1,52) -0.6771 0.284 -2.380 0.017 -1.235 -0.120

sin(2,52) 3.9951 0.099 40.336 0.000 3.801 4.189

cos(2,52) -1.7206 0.264 -6.519 0.000 -2.238 -1.203

y.L1 0.9116 0.014 63.264 0.000 0.883 0.940

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 1.0970 +0.0000j 1.0970 0.0000

-----------------------------------------------------------------------------

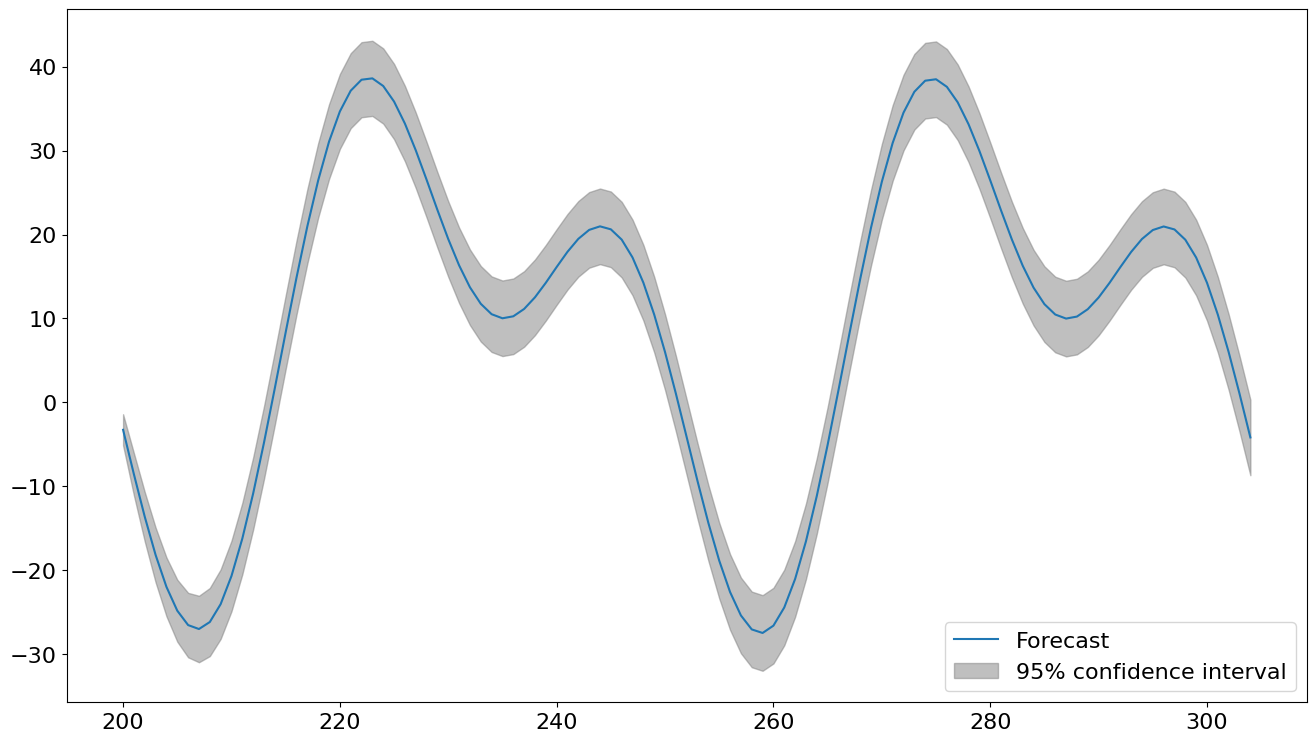

We can use the plot_predict to show the predicted values and their prediction interval. The out-of-sample deterministic values are automatically produced by the deterministic process passed to AutoReg.

[19]:

fig = res.plot_predict(200, 200 + 2 * 52, True)

[20]:

auto_reg_forecast = res.predict(200, 211)

auto_reg_forecast

[20]:

200 -3.253482

201 -8.555660

202 -13.607557

203 -18.152622

204 -21.950370

205 -24.790116

206 -26.503171

207 -26.972781

208 -26.141244

209 -24.013773

210 -20.658891

211 -16.205310

dtype: float64

Using with other models¶

Other models do not support DeterministicProcess directly. We can instead manually pass any deterministic terms as exog to model that support exogenous values.

Note that SARIMAX with exogenous variables is OLS with SARIMA errors so that the model is

The parameters on deterministic terms are not directly comparable to AutoReg which evolves according to the equation

When \(x_t\) contains only deterministic terms, these two representation are equivalent (assuming \(\theta(L)=0\) so that there is no MA).

[21]:

from statsmodels.tsa.api import SARIMAX

det_proc = DeterministicProcess(idx, period=52, fourier=2)

det_terms = det_proc.in_sample()

mod = SARIMAX(y, order=(1, 0, 0), trend="c", exog=det_terms)

res = mod.fit(disp=False)

print(res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 200

Model: SARIMAX(1, 0, 0) Log Likelihood -293.381

Date: Tue, 13 Jan 2026 AIC 600.763

Time: 23:59:12 BIC 623.851

Sample: 0 HQIC 610.106

- 200

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0796 0.140 0.567 0.571 -0.196 0.355

sin(1,52) 9.1917 0.876 10.492 0.000 7.475 10.909

cos(1,52) -17.4351 0.891 -19.576 0.000 -19.181 -15.689

sin(2,52) 1.2510 0.466 2.683 0.007 0.337 2.165

cos(2,52) -17.1865 0.434 -39.582 0.000 -18.038 -16.335

ar.L1 0.9957 0.007 150.751 0.000 0.983 1.009

sigma2 1.0748 0.119 9.067 0.000 0.842 1.307

===================================================================================

Ljung-Box (L1) (Q): 2.16 Jarque-Bera (JB): 1.03

Prob(Q): 0.14 Prob(JB): 0.60

Heteroskedasticity (H): 0.71 Skew: -0.14

Prob(H) (two-sided): 0.16 Kurtosis: 2.78

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

The forecasts are similar but differ since the parameters of the SARIMAX are estimated using MLE while AutoReg uses OLS.

[22]:

sarimax_forecast = res.forecast(12, exog=det_proc.out_of_sample(12))

df = pd.concat([auto_reg_forecast, sarimax_forecast], axis=1)

df.columns = columns = ["AutoReg", "SARIMAX"]

df

[22]:

| AutoReg | SARIMAX | |

|---|---|---|

| 200 | -3.253482 | -2.956589 |

| 201 | -8.555660 | -7.985654 |

| 202 | -13.607557 | -12.794186 |

| 203 | -18.152622 | -17.131132 |

| 204 | -21.950370 | -20.760702 |

| 205 | -24.790116 | -23.475801 |

| 206 | -26.503171 | -25.109977 |

| 207 | -26.972781 | -25.547190 |

| 208 | -26.141244 | -24.728828 |

| 209 | -24.013773 | -22.657568 |

| 210 | -20.658891 | -19.397841 |

| 211 | -16.205310 | -15.072874 |